Afternoon now drives nearly one-third of daily foodservice traffic across both fast-food and restaurant segments, closely followed by lunch. Morning visits account for just 15% of total fast-food traffic, lower than in Northern Ireland and the UK, according to Meaningful Vision’s latest data. While fast-food operators are more active during morning hours, restaurants and pubs attract over one-fifth of their visitors after 6 p.m., underscoring their evening strength.

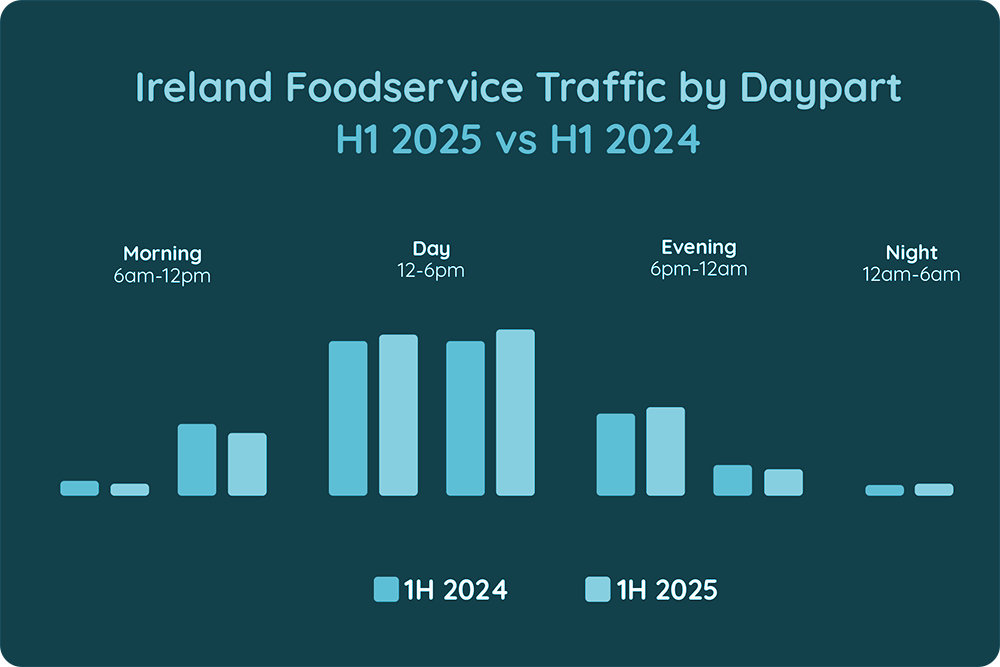

The study reveals a clear shift in Ireland’s daily rhythm of dining. These evolving daypart patterns are redefining growth opportunities across fast-food and café formats, from the first coffee of the day, to the last delivery of the night. The first half of 2025 shows a marked movement away from morning and late-night traffic toward midday and afternoon periods.

Fast-food traffic grew most strongly between 3–6 p.m., with this slot’s share rising from 30% to 32% of total daily visits. In contrast, late-evening traffic (after 9 p.m.) declined from 8% to 7%. Lunch hours also strengthened, up from 30% to 31%, while morning visits fell three percentage points, from 18% to 15% of total daily traffic.

These changes were driven by coffee shops and burger chains, which gained during lunch at the expense of early-morning trade, while burger and pizza outlets captured share from late-evening occasions by focusing on the mid-afternoon and early-dinner window.

Interestingly, the shift varies across the week. Mondays and Fridays show the sharpest movement from morning to lunch, reflecting flexible work schedules, while weekends see traffic shifting from mid-afternoon (3–6 p.m.) to evening hours.

“These patterns are closely linked to Ireland’s changing work culture,” notes Maria Vanifatova, CEO of Meaningful Vision. “Ireland now leads Europe in hybrid and remote work adoption, with about 65% of employees in flexible arrangements which is well above the EU average of 58% and the UK’s 44%.”

Reduced early-day visits mirror fewer office commutes, especially on Mondays and Fridays, dampening morning transactions. Some of this loss is being offset by a growing mid-morning and brunch window, as consumers delay their first out-of-home purchase. Meanwhile, lunchtime activity is increasing, driven by hybrid workers meeting outside the office and seeking quick, value-driven meals that blend late breakfast and early lunch (roughly 11 a.m.–2 p.m.).

Weekend patterns also show consumers eating earlier and spending less in the evening. The rise in 3–6 p.m. traffic likely reflects cost-of-living pressures, with many choosing to dine at home for dinner while maintaining snacking and coffee occasions during the day.