Enhance your understanding of competition in the Foodservice industry

With our revolutionary Market Intelligence System.

Meaningful Vision has been a valuable partner to Five Guys, providing clear, detailed insights into competitor pricing. Their timely and reliable data delivery has played a crucial role in shaping our pricing strategy and supporting informed decision-making in a challenging environment marked by inflation and market uncertainty.

Rory Scallan, Commercial Director, Five Guys

I began working with Maria and the Meaningful Vision team at the beginning of 2025 – prior to this, our business had a huge gap in market data and insights covering the Foodservice and Out of Home channels in Ireland. Now, with access to Meaningful Visions platform and unique understanding of channel and outlet dynamics and changing footfall trends across dayparts and key regions, we are able to make more complete business decisions as now have a fuller market understanding, and it is great to now be in a position to bring much more meaningful data and insights to our customer meetings in this channel. Maria and her team are always supportive in providing us with further analysis and insights when asked, and can only see us expanding the range of data we currently access from Meaningful Vision in the future.

Richard Harten, Market Insights Manager, Coca-Cola HBC Ireland & Northern Ireland

Meaningful Vision has provided valuable insight to our WSH business through their Pricing and Visitor data. These insights have strengthened our understanding of competitor activity and supported more informed commercial decisions across our teams. I would confidently recommend Meaningful Vision to any organisation looking to enhance their strategy with reliable, actionable data

Simon Fennell, Supply Chain Commercial Director

Where can we fill your gaps in competitive intelligence?

Our platform tracks restaurants providing detailed and timely insights into a menu, location, pricing, footfall traffic, and all the ingredients of marketing mix strategies.

What will you get with our solution?

Access to extended industry statistics for effective day-to-day management and strategic business decisions making in a highly competitive marketplace.

High Level of Detail:

By location, day, product item

Flexible Approach:

Track the competition vs selected benchmarks

Convenience:

All data elements in one place

Easy Access:

Online web-based application

Up-to-date Insights:

Weekly data, delivered next week

Good Return on Investments:

Reasonable pricing

Begin your Journey Today

Define your competitors, data needs, and experience our competitor scanner

Access data at your fingertips

Our customers

We support all Foodservice Ecosystem players with the most precise market data

Fast food

Coffee shops

Casual dining

Pubs

Distributors & wholesalers

Food & beverage manufacturers

Packaging & equipment suppliers

Investors & consultancies

How we build our tool

With our deep understanding of food service trends, data sources capabilities, and limitations, we carefully craft a highly accurate and cost-effective product. We strongly believe that the Meaningful Vision Market Intelligence System delivers exceptional value to our clients.

- Big datasets

- Machine learning, AI and other modern data analysis and processing tools

- Unique combination of industry expertise and data analysis competences

We collect data about Foodservice market every day

25K+

outlets

200M+

traffic records during a year

15M+

count of distinct prices a year

100K+

menu and promo activities a year

What our recent data tell

Explore our experts’ opinions as shared with national media and discover our collection of infographics.

Media Coverage

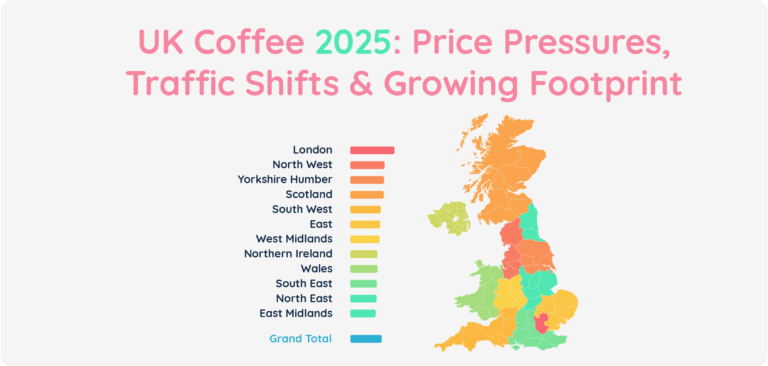

UK Coffee 2025: Price Pressures, Traffic Shifts & a Growing Footprint

Coffee shops are growing and attracting more customers during later hours. This is one of the key UK Market insights in 2025.

Latest posts

Explore the latest trends in the Foodservice Industry to maximize the value derived from data about your competition

Access the latest Foodservice market insights by signing up below

How we can help your business to grow

Get in touch with our expert today to help you find the best solutions for your organization.