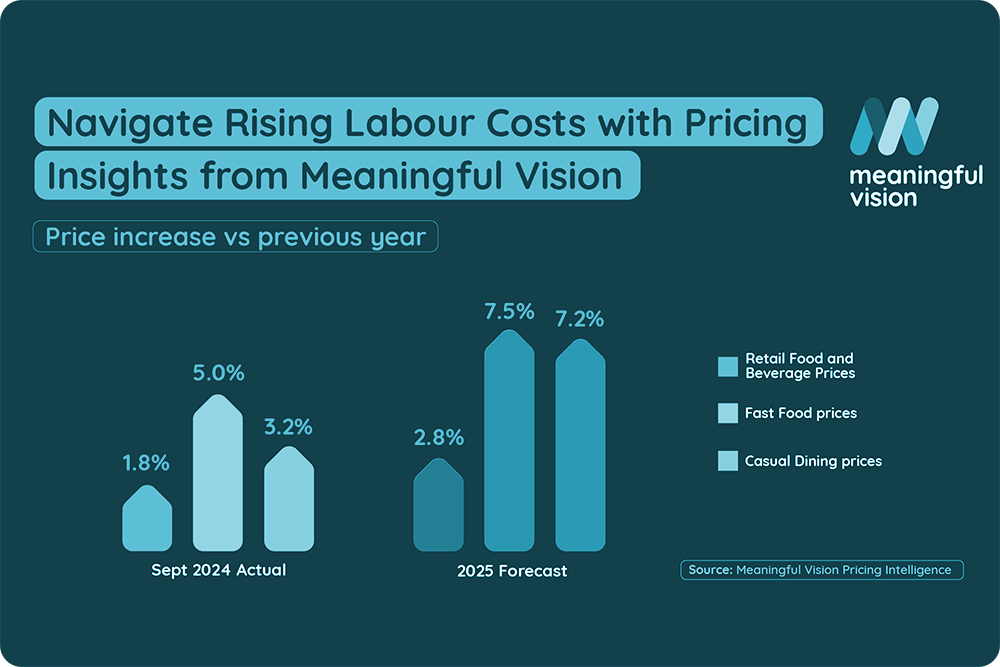

Inflation has been a central concern for businesses and consumers alike over the past year. While the UK’s general inflation rate has slowed—food and beverage prices rose just 1.8% year-over-year in September, according to the Office for National Statistics—the foodservice sector continues to face higher inflation, with rates hovering around 5% in fast food and 3% in casual dining, per Meaningful Vision’s monthly price tracking of over 100 UK brands.

Adding to these pressures, the UK government’s recent Budget announcement has outlined a significant rise in labour costs, with UK Hospitality estimating a 10% increase. Labour-intensive sectors like foodservice are expected to bear the brunt of these changes, with anticipated cost increases ranging from 1% to 4% across retail, fast food, and casual dining. For smaller or independent operators already operating on razor-thin margins, absorbing these costs seems nearly impossible.

Impact on the Consumer Landscape

The foodservice industry faces a critical question: Can these rising costs be fully passed on to consumers? Evidence suggests that demand may be too fragile to sustain significant price hikes. Fast food traffic, for example, remained flat at just 0.2% growth from January to September and experienced a like-for-like decline of 4%. Much of the limited growth stems from new openings rather than increased patronage at existing locations.

If businesses choose to pass on costs, Meaningful Vision estimates foodservice inflation could climb to 7% by next year. This could lead many consumers, especially families, to forego dining out in favour of more economical home-cooked meals. Such a shift would likely intensify competition within the already concentrated fast-food market, where the top 100 brands capture 60% of consumer spending. Larger chains, which have expanded their store counts by 3% in the past nine months, might weather the storm better, prioritizing market share over profitability. Meanwhile, independent operators could struggle without economies of scale or negotiating power.

Price Wars and Promotional Strategies

In response to these challenges, fast-food brands have embraced budget-friendly promotions. McDonald’s introduced a £2.79 breakfast deal and a £3 summer bundle, KFC launched a £5.49 meal deal, and Domino’s rolled out £5-£6 lunch offers. These promotions reflect a shift from encouraging additional spending to simply retaining price-conscious customers.

Looking ahead, Christmas pricing strategies could provide further insights. Early indicators show seasonal menu items priced around 6% higher, with an uptick in promotional meal deals. Whether these adjustments will help businesses maintain traffic or further tighten margins remains uncertain.

The Need for Data-Driven Decisions

Amid this volatile environment, data becomes indispensable. Tools like Meaningful Vision’s pricing intelligence platform enable businesses to stay competitive by analysing category-specific and regional pricing trends. With such resources, businesses can navigate cost pressures, optimize pricing strategies, and turn challenges into opportunities, ensuring sustainability even in a landscape shaped by rising costs and inflationary pressures.