The UK’s foodservice sector has been navigating a volatile inflationary period over the past five quarters. Delivery and dine-in/takeaway services have experienced their own discrete trends as prices adjusted to counter rising costs, but the latest data from Meaningful Vision Price Intelligence reveals these separate strands have slowly converged on the more balanced growth rate seen in the first quarter of 2025.

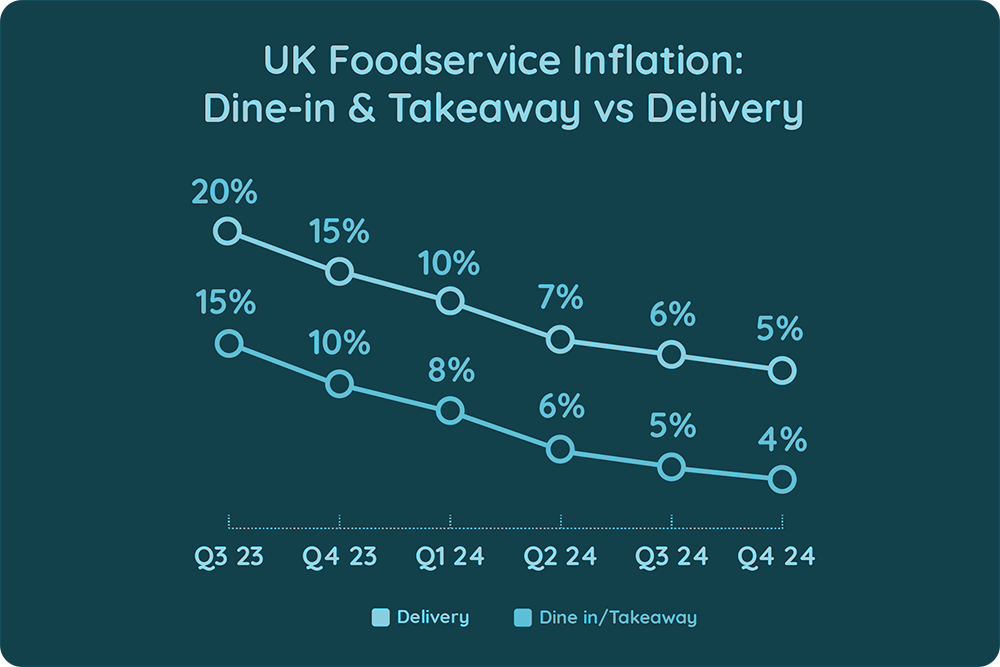

In Q3 2023, the sector grappled with peak inflationary pressures. Delivery prices soared to a staggering 20% year-on-year increase, reflecting the heightened costs associated with logistics and third-party platform fees. Dine-in/takeaway prices, while still substantial, registered a 15% rise, indicating a comparatively lower impact from these external factors.

However, as we transitioned into 2024, a consistent downward trend emerged across both channels. Dine-in/takeaway price inflation cooled to 8% in Q1, eventually reaching a more manageable 4% by Q4. Delivery prices followed a similar trajectory, albeit from a higher starting point, declining to 10% in Q1 and ultimately aligning with dine-in/takeaway at 5% in Q4. This gradual alignment in the rate of price growth indicates a stabilisation of price pressures, possibly driven by easing inflation, optimised operational efficiencies, and/or strategic pricing adjustments by foodservice operators.

Despite this apparent harmonisation between the two strands, a significant price differential persists. Delivery prices remain 18% higher than their equivalent for dine-in/takeaway, raising concerns about affordability in the face of potential renewed inflationary pressures. This discrepancy may prompt a shift in consumer behaviour, with a potential decline in delivery orders as budget-conscious customers opt for more economical dine-in or takeaway alternatives.

Maria Vanifatova, Meaningful Vision’s CEO notes “Our data illuminates the evolving price dynamics within the UK foodservice sector. The convergence of delivery and dine-in/takeaway price growth reveals the market adapting to inflationary challenges. However, the persistent price differential highlights the need for delivery platforms to address concerns among consumers with respect to affordability. Mitigating against a potential decline in demand, we anticipate a rise in targeted promotions and offers, squarely aimed at stimulating consumer interest in delivery services. Agility, and a responsive marketing strategy will be crucial in the fight to maintain market share and customer loyalty.”

Read more on the foodservice trends and challenges in our article “Foodservice Industry Braces for New Wave of Inflation”.

.