New data from Meaningful Vision reveals the subtle shifts in consumer traffic across Ireland’s foodservice industry that are influencing changes to regional and daypart performance. Most obviously, the overall number of foodservice visits declined by 4% year-on-year in Q1 2025, reflecting the concerns of increasingly cautious consumers.

Burger and Chicken outlets experienced the most significant drop in footfall. Interestingly, these segments also recorded the largest increase in the number of stores, possibly indicative of overextension amid slowing demand. Meanwhile, coffee shops and pizza venues proved more resilient, showing the smallest declines in visitor numbers.

Regional dynamics tell a compelling story. While Dublin experienced a notable 7% decline in traffic, the rest of the country saw a modest 1% increase. This shift suggests growing opportunities outside the capital, as traffic patterns begin to decentralise. Northern Ireland in particular, boasts healthier traffic trends, with an almost 5% increase year-on-year, closely linked to the growth in the number of outlets in the region.

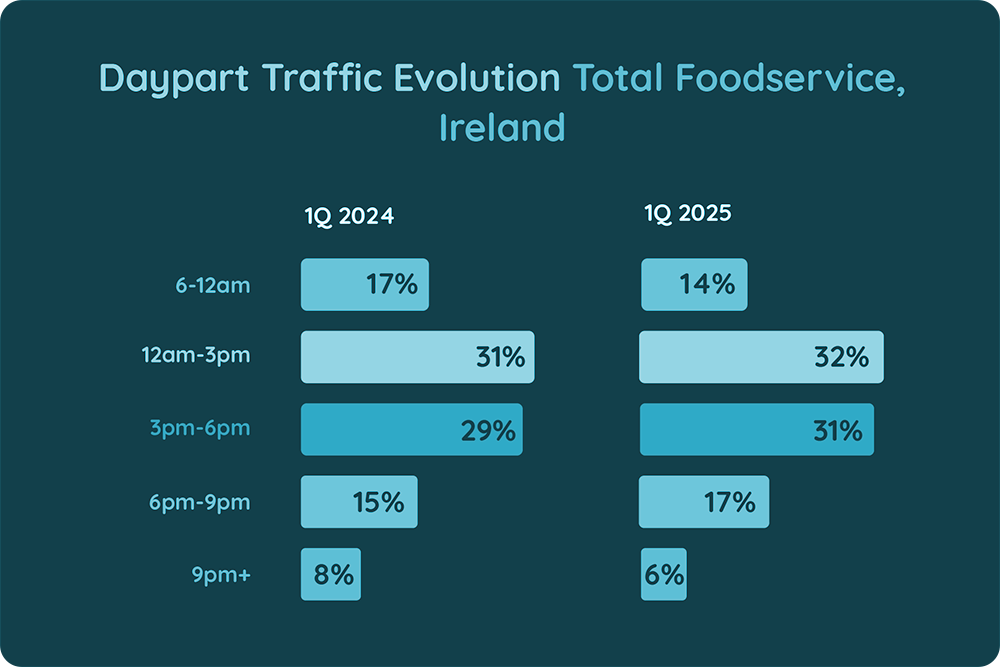

Morning traffic declined slightly, falling from 17% to 14% of total visits. Both early (6 am – 9 am) and mid-morning (9 am – 12 pm) periods saw reduced footfall. This drop was observed across all major foodservice segments, suggesting fewer consumers are eating out early in the day.

The lunchtime period gained momentum, with its share increasing by 1% in restaurants and almost 2% in fast-food, continuing the trend observed in 2024. Fast-food segments performed particularly well here, posting a 5% year-on-year increase in visits, though burger and chicken chains were exceptions and registered declines.

The afternoon period saw the strongest share gain, rising from 30% to 32% in fast-food, with a 4% increase in the number of guests. While the burger and chicken segments declined slightly, their losses were less than during lunchtime.

Dinner emerged as the fastest-growing time slot, with a 5% increase in traffic compared to Q1 2024 for fast-food, and an even higher 7% growth for restaurants and pubs. Its market share in fast-food rose from 14% to 16%, driven primarily by rising visits to burger and pizza restaurants. In restaurants this daypart is responsible for 25% of overall daily traffic and grew by 2% as well.

By contrast, the late evening period showed a consistent decline in traffic across all segments, highlighting a shift away from late-night dining.

Maria Vanifatova, Co-Founder and CEO of Meaningful Vision Ltd notes, ” Despite an overall drop in visits, the data presents clear growth opportunities, particularly in afternoon and dinner dayparts, and outside of Dublin. While certain segments like burgers and chicken face traffic challenges, the growing number of outlets signals continued brand investment and confidence. Understanding when and where consumers are dining will be crucial for foodservice operators looking to navigate Ireland’s evolving market landscape in 2025”.

Register to our first-ever webinar dedicated to the evolving trends and exciting prospects within the Irish Foodservice Industry.