New data from Meaningful Vision reveals significant changes in how and when Irish consumers are dining out in the first quarter of 2025. While overall visits to foodservice establishments saw a 4% year-on-year decline, a deeper dive into daypart traffic uncovers crucial trends and opportunities for both fast food outlets and traditional pubs and restaurants.

Fast – Food Sees Afternoon and Dinner Surge

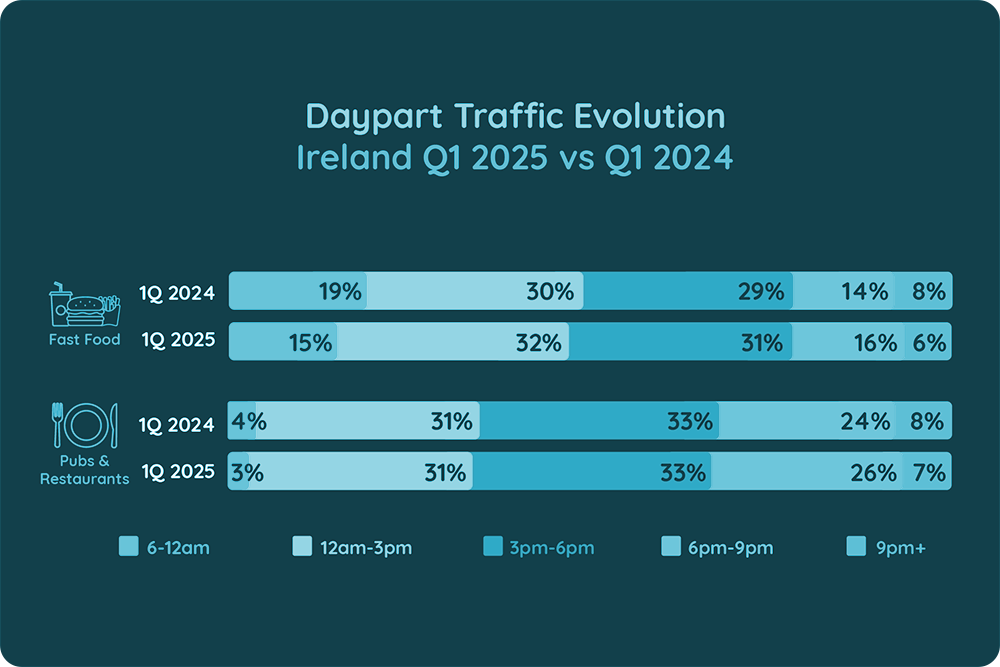

Fast – food experienced a notable drop in morning traffic, falling from 19% to 15% of total visits. However, afternoon (12am – 3pm) emerged as a period of significant growth, rising up to 32% of total fast – food traffic. This suggests a clear shift towards later daytime meals or snacks for fast food consumers.

Lunchtime also continued its upward trend for fast-food, with its share increasing by almost 2%. This growth, particularly in the afternoon and lunchtime, was significantly contributed to by coffee shops and pizza restaurants.

The dinner daypart proved to be the fastest-growing for fast – food, with traffic increasing, and its market share rising to 16%. This dinner growth was primarily driven by burger and pizza restaurants.

Pubs & Restaurants Thrive at Dinner

Pubs and restaurants also saw a positive trend at lunchtime, maintaining 31% of total traffic.

However, it was the dinner period that saw the strongest surge for pubs and restaurants, with a remarkable growth in this slot, now accounting for 26% of their overall daily traffic. This indicates a clear preference for evening dining experiences in these establishments.

A Decline in Late Evening Dining

Conversely, the late evening period showed a consistent decline in traffic across all segments, dropping to 6% for fast – food and to 7% for pubs & restaurants. This highlights a subtle but important shift in consumer behaviour, indicating a reduced preference for late-night dining.

Maria Vanifatova, Co-Founder and CEO of Meaningful Vision Ltd, highlights these evolving patterns: “Despite an overall drop in visits, the data reveals clear growth opportunities, particularly in afternoon and dinner dayparts. Understanding when and where Irish consumers are dining in 2025 will be crucial for foodservice operators looking to succeed in a market undergoing rapid, and often surprising changes.”

These granular insights into daypart traffic are essential for foodservice operators to fine-tune staffing, menu offerings, and promotional strategies, ensuring they align with the evolving habits of Irish consumers.

For more insights into the Ireland foodservice market, you can watch the Meaningful Vision webinar, “Ireland’s Foodservice Landscape 2025: What’s Next for Growth & Competition?”, at your convenience.