A fascinating and complex dynamic is at play in Ireland’s fast-food market, where pricing strategies reveal significant differences from their UK counterparts. An in-depth analysis by market intelligence firm Meaningful Vision, which tracks data from over 60 fast-food chains in Ireland and more than 100 in the UK, highlights these intricate trends.

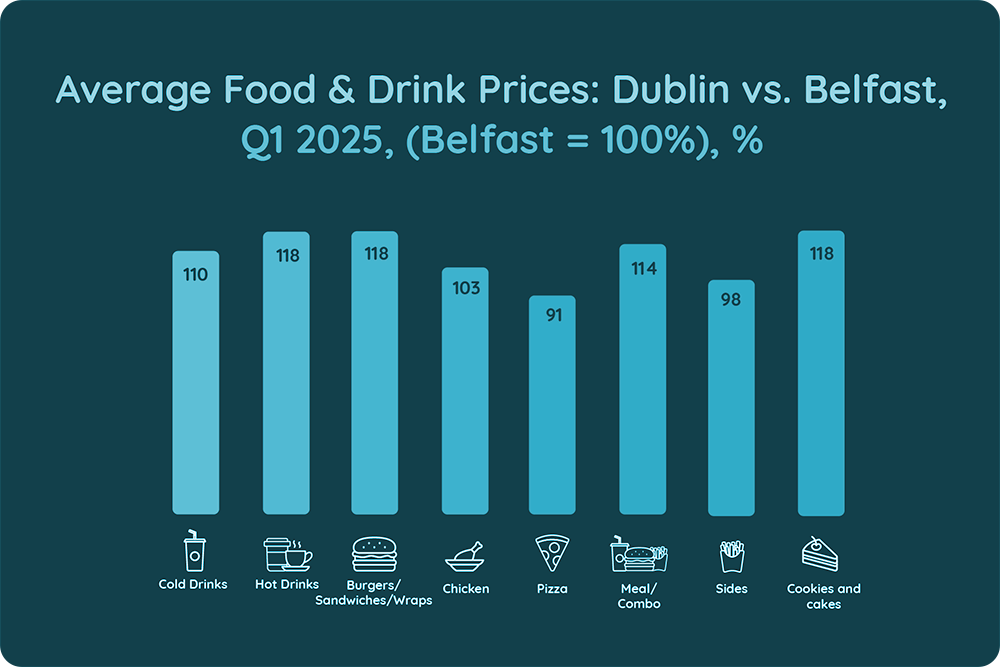

On average, fast-food prices in Dublin run about 10% higher than in Belfast. This gap is especially noticeable in certain categories. Hot drinks, burgers, sandwiches, wraps, and desserts like cookies and cakes are all 18% more expensive in Dublin. Meal combos and cold drinks also see higher prices, costing 14% and 10% more, respectively. However, the trend isn’t uniform across the board. The price for chicken, for example, is only 3% higher in Dublin, showing a much smaller variance between the two cities.

The most striking exceptions to this trend are pizza and sides, which are notably cheaper in Dublin than in Belfast by 9% and 2%, respectively. This pizza price anomaly is a significant outlier; a medium pizza in an Irish shop costs around €15, compared to about €18 in the UK. This is largely attributed to Ireland’s strong local pizza chains, such as Apache Pizza and Four Star Pizza, which command significant market share and can set more competitive prices. In contrast, the UK market relies heavily on promotions, with average discounts of 27% or “buy one, get one free” offers, which creates a higher perceived base price for consumers.

Further complexity exists within Ireland’s own market. A cold drink at a coffee shop can cost 30% more than at a chicken or pizza outlet, while their sandwiches are about 30% cheaper than an average burger. These intricate differences underscore how the Irish and UK markets, despite their proximity, operate with distinct pricing structures.

As Maria Vanifatova, the CEO of Meaningful Vision, comments: “What this data reveals is that Ireland is not simply a smaller version of the UK market; it’s a unique ecosystem with its own consumer behaviours and competitive pressures. For fast-food brands to thrive, they must move beyond broad regional strategies and embrace granular, data-driven insights to tailor their pricing and promotions right down to the city level. Success lies in understanding and responding to these local nuances.”

Download latest infographics and contact our experts to get your tailored report.