During the first half of 2025 the casual dining and fast-food sectors have responded with an increase in pace to intensifying competition. Meaningful Vision tracks pricing and promotion signals across more than 60,000 UK outlets, combining information on location, traffic, and store openings and closures at brand and segment level. Its platform helps operators to benchmark the competition, forecast demand and outflow from independents to chains, and to pressure-test roll-out plans. Analysis undertaken on the most recently available data reveals, despite grappling with a challenging economy, the market is still adding new sites, but with greater caution than seen previously.

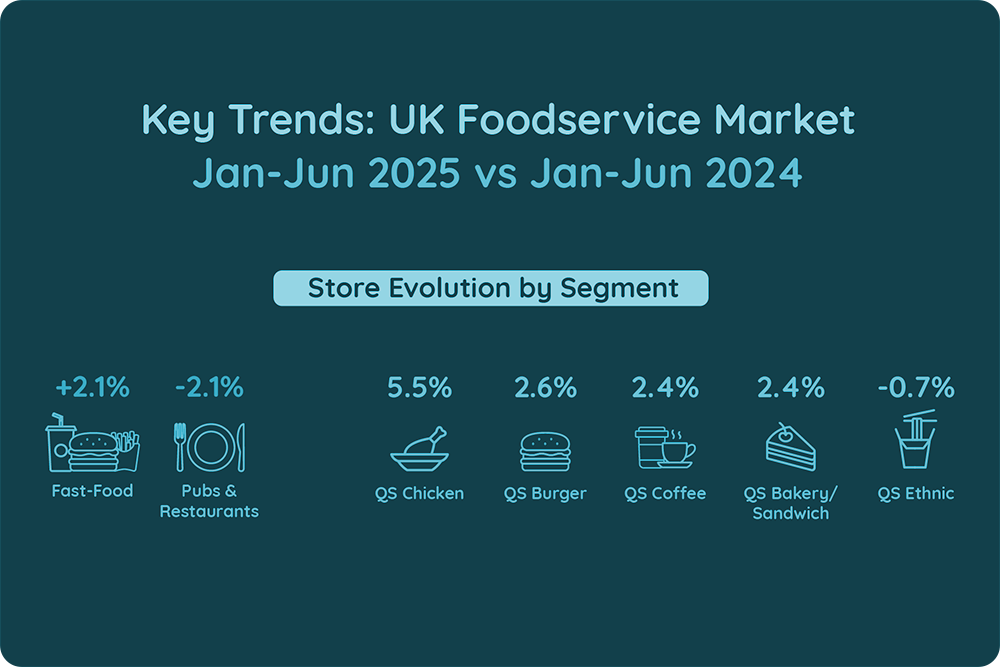

In headline terms, the total store base grew 1.0% in January–June 2025, less than half the 2.5% expansion recorded a year earlier. Fast-food remained the growth engine, though it too eased back, to 2.1% from 4.0% in H1 2024. Full-service formats continued to retrench but at a slower rate, with pubs and restaurants down 2.1% versus a 3.8% decline last year. This pattern is consistent with an industry managing higher labour and input costs against softer like-for-like demand: operators are opening, just more selectively.

Among quick service restaurants, the pecking order narrowed. The Chicken segment still leads the way, but cooled markedly, slowing from a blistering 12.9% increase in H1 2024, to 5.5% this year. This gradual return to more familiar rates came despite the arrival of new players with ambitious plans. The potential for acceleration in the second half of the year remains, but for now, the rate of expansion has moderated as site availability tightens and returns begin to normalise.

The Burger segment showed unusual consistency, holding at 2.6% growth and underlining the strength of established brands. Bakery and sandwich players added 2.4%, reflecting cautious infill strategies, while coffee matched that pace at 2.4%. Ethnic formats slowed sharply, advancing just 2.2%. The Pizza segment was the only one to contract, slipping into net closures at –0.7%, a sign of sustained pricing pressures and uneven returns across the category.

Footfall trends help explain the apparent slowdown. While overall fast-food traffic nudged higher year on year, like-for-like visits were negative, implying that new stores are redistributing demand rather than creating it. That reality pushes capital toward higher-quality catchments and tighter formats, and it raises the bar on each additional site.

“As the first half of the year has shown, the fast-food market is still expanding, but with a slightly more cautious approach,” says Maria Vanifatova, CEO of Meaningful Vision. “When like-for-like demand is flat, simply adding outlets becomes a limited strategy. Winners will use granular, data-driven location planning and align pricing and promotions to the realities of each neighbourhood.”

“The second half of 2025 will test this thesis. For now, growth continues, albeit in a more selective manner. Sensible decision making by operators demands a data driven approach, supported by the latest factual evidence from the marketplace. Meaningful Vision continues to track openings and closures to help brands calibrate expansion to real-world demand.”

Read more on the UK Foodservice trends in our blog and register for the upcoming Webinar UK Foodservice segments shaping the industry in 2025.