Meaningful Vision’s analysis of data collected through 2025 highlights the growing dominance of chicken within the UK fast-food market. The chicken segment is outpacing the rest of the market across footprint, visits, and menu share, with this trend indicative of significant changes in the competitive environment.

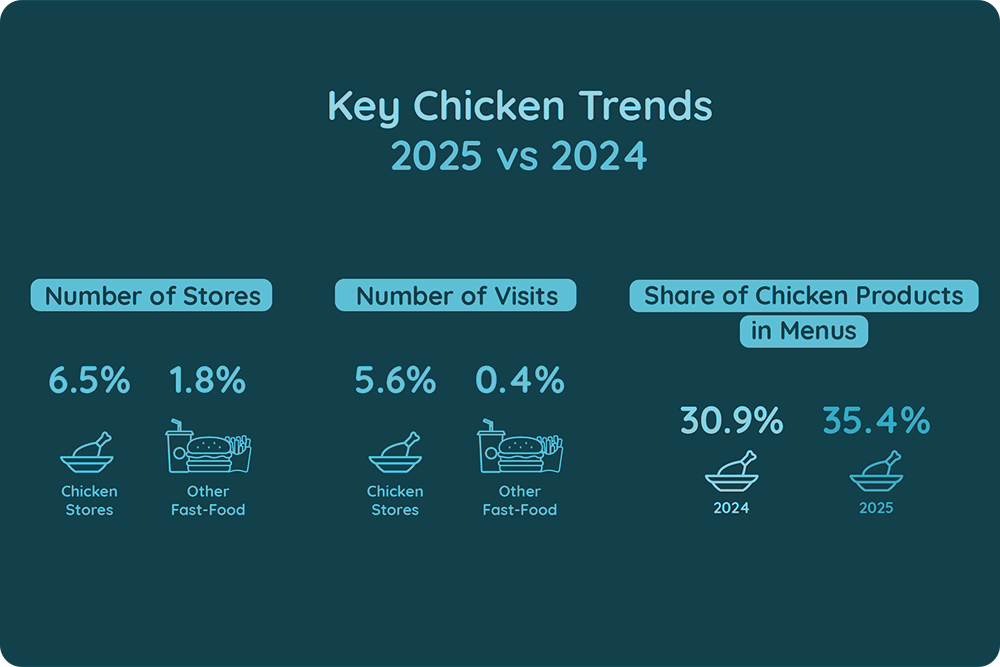

During 2025, the number of chicken-focused outlets rose by 6.5% year on year, well ahead of the 1.8% growth recorded across other fast-food formats. That expansion translated into stronger demand: visits to chicken restaurants increased by 5.6%, compared with just 0.4% growth for the wider fast-food sector. The gap between outlet growth (+6.5 %) and visits (+5.6%) implies average visits per chicken outlet fell by roughly 0.8% year on year, a sign that footprint expansion is already putting pressure on per-store traffic even as the category grows.

Beyond footprint and traffic, chicken’s influence is increasingly visible on menus. The share of chicken products across fast-food menus climbed from 31% in 2024 to 35% in 2025. Reflecting the product’s advantages in a price-sensitive environment, fast-food chicken has strong value perception and broad menu versatility, making it ideal for promotions, shareable formats and limited-time offers. Operators are leaning into those strengths to drive conversion across dine-in, delivery, and digital channels.

Even among chains where chicken is not the core item on the menu, attempts are being made to capture a share of the action. Non-chicken brands such as Wendy’s and Domino’s have extended their side propositions and beefed up chicken offerings to benefit from the category’s momentum. That crossover reinforces the point: chicken is now a cross-category growth lever, not just a niche specialism, and it is reshaping how full portfolios are constructed.

Competition is intensifying, with new entrants, alongside a number of established international brands, arriving to reshape the market. Brands such as Popeyes and Wingstop have introduced new formats, and raised the level of digital engagement and experience-led propositions for UK customers. Further new arrivals – Dave’s Hot Chicken, MB Chicken and large US brands like Chick-fil-A and Raising Cane’s, are expected to expand aggressively.

Strategically, the implications are wide. For operators, the opportunities presented by chicken have undergone a transformation, from that of a high-growth sub-segment, to a core product: for those that have entered the market, menu engineering, value-buckets, limited-time offers, and digital loyalty will be essential to protecting margins while attempting to scale. For roll-out and real-estate decisions, rapid expansion makes location selection and portfolio mix decisive; brands will need to balance high-turnover city sites with smaller neighbourhood formats in an effort to manage declining average traffic per store. Independents face heightened pressure: those that cannot match scale, marketing or digital capability will be squeezed, while operators that localise offers or specialise can still carve out viable niches.

The rise of chicken also creates opportunities up and down the value chain. Suppliers and CPG partners can benefit from larger, more predictable demand for chicken-centric SKUs, sauces and co-branded innovations. For investors, the combination of footprint expansion, stronger traffic growth and digital-first entrants makes chicken-focused concepts attractive, although investors should factor in longer roll-out timelines and potential short-term margin pressure as chains prioritise share.

Meaningful Vision’s meticulous analysis of data for 2025 shows that chicken is no longer a peripheral trend: its influence is shaping menus, store development and traffic patterns across the fast-food landscape. As competition increases and international entrants scale, the winners will be the operators that align aggressive roll-out, superior location strategy, and disciplined menu engineering with best-in-class digital capabilities.