According to Meaningful Vision’s data, the number of promotions in restaurants has increased significantly in recent years, with the number of promotions in casual dining rising by 25% in QSR and 13% in the first half of 2024. Meanwhile a relatively modest 3% growth was witnessed in the delivery sector, where promotional deals are already well represented with frequent and numerous offers an established feature of the market.

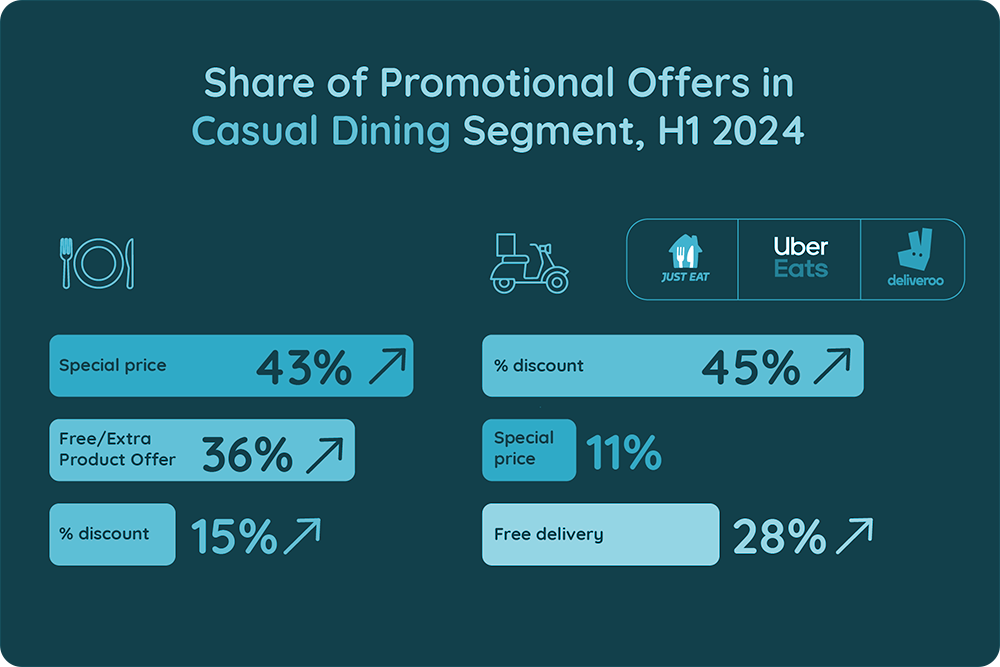

Price promotions are the favoured strategy of the UK’s top brands, constituting 64% of promotional activity in casual dining, but what are they offering, and how do dine-in promotions differ from those of the delivery channel?

In the casual dining sector special price offers are less prevalent than in QSR, representing 43% of promotions. Free, or extra products are also popular with a little over one third of all promotions, 36%. Frankie & Bennys offer a free pizza when you purchase any drink, and ASK Italian offers a deal of “2 for1” on main meals, or free dessert when purchasing a main meal with an email code. TGI Fridays promote their “Kids eat for free” special offers.

Absolute discounting has a smaller share than price promotions or special prices, with a 28% share of promotions in the delivery channel, and 15% share of dine-in promotions.

Many restaurant chains are focused on depart specific promotions, for example TGI Fridays have introduced a weekday lunch special.

Maria Vanifatova, the Meaningful Vision CEO comments: “The UK foodservice industry is witnessing a surge in promotional activity, driven by the need to attract and retain customers in a competitive market. While price promotions remain dominant, we’re seeing a growing focus on special offers, freebies, and targeted deals. Restaurants are leveraging digital platforms and tailoring promotions to specific demographics and times of day to maximise their impact”.

Read the full story here.