An examination of data gathered in March reveals several reasons for optimism. According to Meaningful Vision’s report, Foodservice Inflation dropped back to below 9%, and the rate of decline in consumer traffic also slowed compared with the same period in 2023. The leap-year calendar also brought benefits which positively impacted trends in 2024. The additional day in February boosted traffic for the month by 3.5% over 2023. While March 2024 demonstrated a smaller decline vs 2023, owing to the Easter holiday falling in March, rather than in April as was the case in 2023.

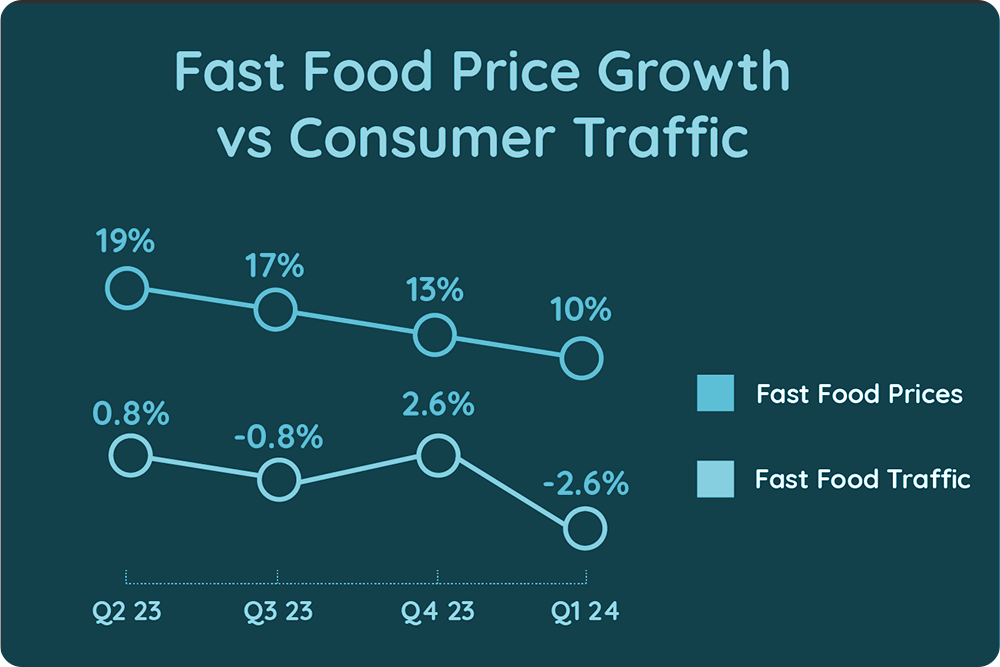

In Q1 2024, total traffic declined by 3% compared to the previous year, with March witnessing a drop of -2.6%. Traffic performance for restaurants and pubs significantly improved in March, achieving a 6% growth. Despite these encouraging numbers, the Fast-Food sector continues to suffer from a general decline in total traffic, with March showing a further 4.2% reduction in footfall. Only Bakeries and Sandwich shops showed resilience with modest growth, although primarily due to strong performances reported by several of the leading chains.

The increase in traffic during Easter 2024, relative to the previous non-Easter week, remained at the same level as last year, around 10-12%. However, owing to the leap-year, Easter2024 had a significant impact on the numbers returned in March. Without the positive effects of the Easter holiday, traffic witnessed by restaurants and pubs would have actually declined by 2% for the month, compared to the 6% growth observed.

A positive trend was seen in the further softening of Foodservice inflation, which in March fell below 10%. We can now observe a slowdown in price inflation for both restaurant dining and delivery. Year-on-year price growth in fast-food restaurants was recorded at 7% in March, while for Delivery aggregators the number was 9%. The relative rate of price growth witnessed by Delivery versus Dine-in reveals another visible trend as the rate of price increases for delivery has slowed more rapidly than for dine-in prices. In Q3 2023, Food inflation in delivery was 5% higher than in restaurants (15% and 10% correspondingly), however, by March, this gap had decreased to 3%.

Market conditions remain challenging even with the slowdown in traffic decline and inflation, comments Maria Vanifatova, CEO of Meaningful vision. Promotions, including Meal Deals and Limited Time Offers, remain key instruments in both customer retention and maintaining a competitive advantage over rivals. While prices have risen on average by 10% in Q1 2024 compared to the same time last year, LTOs and Meal Deals are 5% cheaper this year and are playing a key role in driving consumer demand. We believe this trend will continue in the coming year as unsettled economic conditions in the wider economy persist.

More on fast-food industry trends read here.