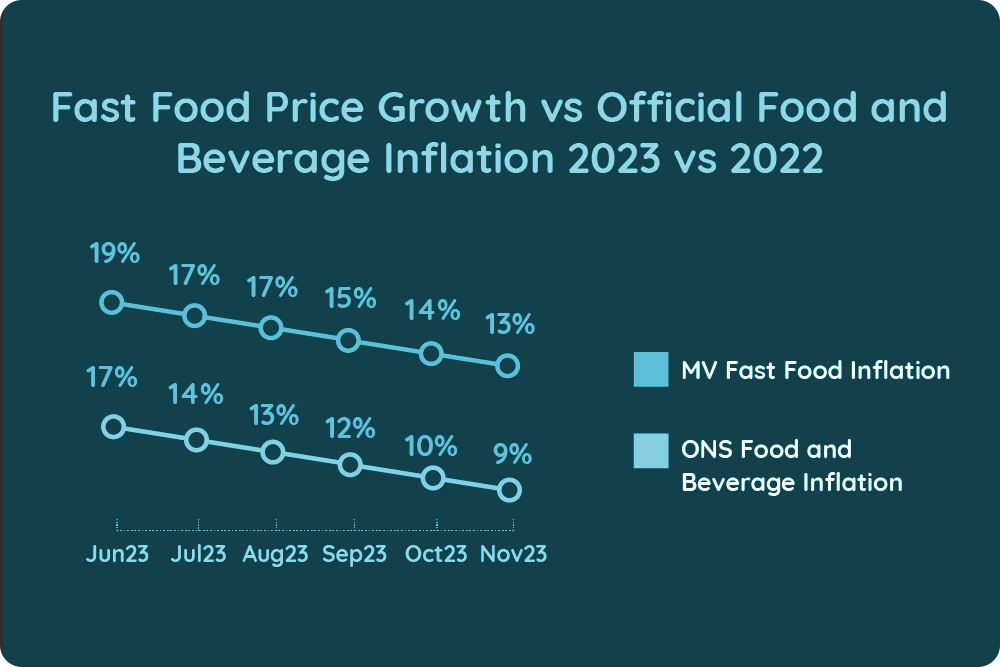

In the second half of 2023, the UK’s hospitality industry experienced a notable shift in food pricing dynamics, particularly within the fast-food sector. The UK’s Office for National Statistics reported the core CPIH annual inflation rate was 5.2% in November 2023, while prices for food and beverages went up by 9%. Additionally, it reports a slowdown in the rate of price increases for the food and beverage sector by 8%, from 17% to 9% in the latter half of 2023.

According to our thorough analysis of the top 100 chains in fast food, coffee shops, and casual dining, major UK fast-food chains encountered an average 16% price surge compared to the previous year. Despite a 6% slowdown in price rises across the industry, fast-food, coffee shop, and casual dining prices outpaced the general inflation rate for the food and beverage sector.

Maria Vanifatova, CEO of Meaningful Vision, underscores this observation, noting that while the deceleration in food price inflation may seem positive, it’s crucial to recognize the swifter pace at which prices in the hospitality sector have escalated. She emphasizes the potential limitations faced by operators amid declining consumer demand, which could impede further price hikes.

Analysis indicates a decline in the rate of price increases across various sectors, notably in dine-in and takeaway services compared to delivery. In fact, foodservice price inflation for major aggregators like Deliveroo and JustEat was 5% higher than for dining-in establishments. Additionally, price hikes varied across different product categories, with main meals experiencing slower increases compared to snacks.

Regional disparities also emerged, with price increases varying significantly between different UK cities. While overall rates of price increases declined in tandem with national trends, certain regions exhibited more rapid declines than others.

Despite the 6% slowdown in price rises, overall foot traffic in the hospitality industry decreased by 3% in the second half of 2023, posing challenges for operators. To navigate these economic conditions successfully, industry players must adopt strategic approaches beyond mere price adjustments. Differentiated pricing, meal deals, and promotions, informed by comprehensive market insights like those provided by Meaningful Vision, will be crucial strategies for driving consumer demand and sustaining growth in 2024.

Learn more about our Solutions to stay ahead of your competition.