UK fast food continued to outperform the wider foodservice market in 2025, but traffic trends reveal a more nuanced picture beneath the headline resilience. According to Meaningful Vision data, fast-food visits increased by 0.9% year on year, while restaurants and pubs together recorded a decline of almost 7%.

The strongest performance came early in the year. When adjusted for the leap year effect, the first quarter of 2025 was broadly flat, with April and May delivering the strongest year-on-year gains. Momentum weakened in the second half, with September emerging as the weakest trading month after February. This pattern highlights ongoing pressure on visit frequency as inflation and higher menu prices continue to weigh on consumer confidence.

“Fast-food chains expanded their store base by close to 2% in 2025, more than double the rate of traffic growth, which resulted in a decline of around 1% in like-for-like visits,” said Maria Vanifatova, CEO and Founder of Meaningful Vision. “While fast food remains more resilient than the rest of the foodservice market, visits are not increasing at the same pace as store openings. That gap is putting pressure on average traffic per store, even in segments that appear to be growing.”

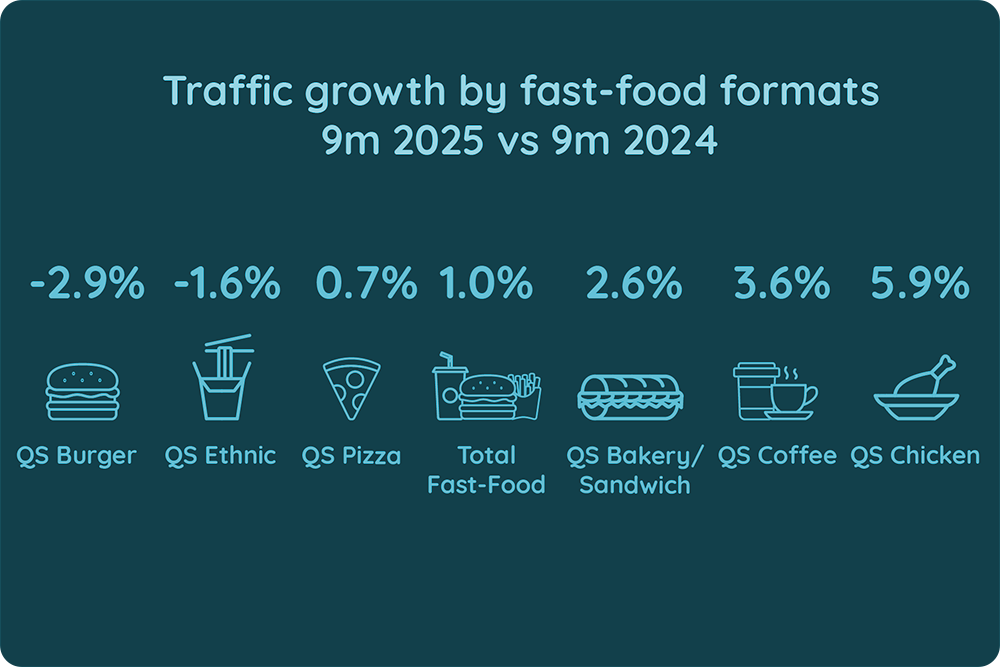

Performance varied significantly by segment. Quick-service chicken restaurants were the clear winners, with traffic up nearly 6% year on year, supported by expansion and strong value perception. Coffee shops also performed well, posting growth of around 3.6%, while bakery and sandwich formats added approximately 2.6%. In contrast, burger chains saw visits decline by close to 3%, while ethnic fast-food formats also recorded falling traffic, reflecting rising price sensitivity and intensifying competition.

Daypart trends help explain where pressure is emerging. Meaningful Vision data shows that the modest 0.9% increase in fast-food traffic during 2025 was concentrated almost entirely in daytime occasions. Breakfast and early lunch proved the most resilient, supported by coffee shops and bakery-led formats. Lunch and mid-afternoon visits between 3:00 and 6:00 pm delivered the strongest uplift, driven primarily by chicken concepts.

By contrast, evening demand weakened. Dinner visits between 6:00 and 9:00 pm declined year on year, while late evening recorded the sharpest drop of any daypart. This reflects reduced discretionary spending and consumers increasingly trading down from full-service dining in the evening. As a result, traffic growth is no longer evenly distributed across the day but concentrated in value-led, convenience-driven occasions aligned with lower spend and shorter visits.

Regional trends further underline these shifting dynamics. London is no longer the fastest-growing region for fast-food visits. Meaningful Vision data shows Northern Ireland leading traffic growth in 2025, followed by the South of England, reflecting lower saturation levels and more targeted development strategies.

Fast – food is expected to remain relatively resilient as consumers continue to trade down from casual dining. However, with prices still rising and outlet numbers increasing, sustaining traffic growth will depend on sharper value propositions and a clearer understanding of where genuine demand still exists across locations, segments and dayparts.