Meaningful Vision’s Competitive Intelligence System provides insights into consumer traffic trends in the fast-food markets of the UK and the Republic of Ireland, offering valuable data to restaurant operators.

Morning Traffic:

In the Republic of Ireland, morning traffic accounts for approximately 15% of all daily fast-food visits, primarily driven by coffee shops and bakeries. In the UK, morning traffic stands at 18%, reflecting a faster pace of life and longer commutes, particularly in cities like London, Manchester, and Birmingham. The UK experiences a significant morning rush, especially in coffee shops, where picking up coffee on the way to work or enjoying a quick breakfast is something of a tradition. With more coffee shops per capita and a higher share in the QSR market, the UK exhibits greater morning traffic intensity in coffee outlets compared to Ireland.

Lunchtime Patterns:

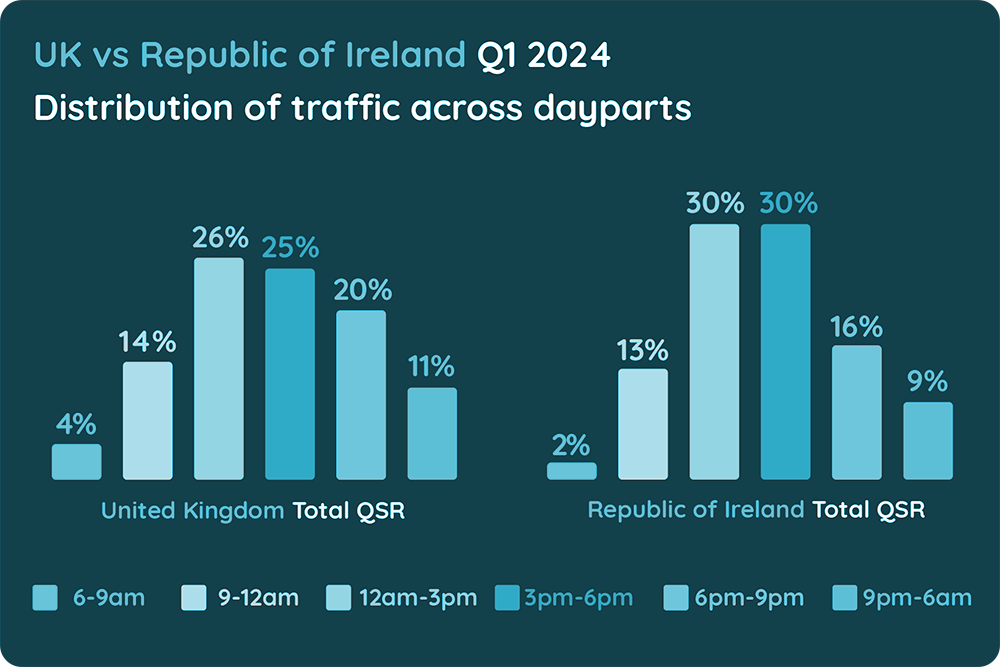

Lunch hours constitute a substantial proportion of fast-food visits, with coffee shops and bakeries continuing to attract visitors during the middle of the day, a feature common to both territories. In the UK, lunchtime share in total traffic is slightly lower, with Sandwich Shops being a popular choice owing to the convenience of grabbing a quick sandwich whilst on the go. In Ireland, burger outlets dominate the premium share during lunchtime, taking precedence over sandwich and coffee chains. Overall lunch traffic accounts for 30% vs 26% in Ireland and the UK and respectively.

Afternoon and Evening Traffic:

In the UK, favourable periods for fast-food traffic extend into the afternoon, with consistent footfall observed until early evening. After 6pm, traffic accounts for 33% in the UK compared with only 25% in Ireland. Pizza chains capture almost half of consumer traffic after 6pm in Ireland, while in the UK, they have a higher portion of traffic during the daytime.

Various factors contribute to the difference in traffic to fast-food restaurants, including social and work culture, urban vs. rural distribution, dining habits, and economic influences. For instance, longer working hours or more social engagements in the UK may drive people to opt for fast food for convenience in the evening.

Maria Vanifatova comments: “While there are similarities in consumer traffic trends between the UK and Ireland, there are also notable differences, most evident in morning rush-hour patterns and evening traffic distribution. These differences reflect unique factors in each country, such as transportation systems, urban and rural areas, population density, and restaurant density. The UK, particularly England, has a greater number of urbanized areas, therefore people spend more time commuting and eating out. By contrast, Ireland has a lower population density and is famous for its large rural areas and gentler pace of life. However, restaurant density in Dublin is higher than London’s, making the Irish capital one of Europe’s top destinations for fast-food.”

Understanding consumer traffic patterns is essential for optimizing staffing, refining menu offerings, and tailoring marketing strategies to leverage peak hours in both regions. Restaurant operators can use this data to identify growth opportunities and make informed decisions to enhance operational efficiency.

More on Fast-food trends in Republic of Ireland read here.