Walk down any Irish high street this year and the change is visible: fewer bakeries, more coffee chains, and a shifting mix of takeaway favourites. Inflation may dominate the headlines, but 2025 is also reshaping Ireland’s foodservice map, one store at a time.

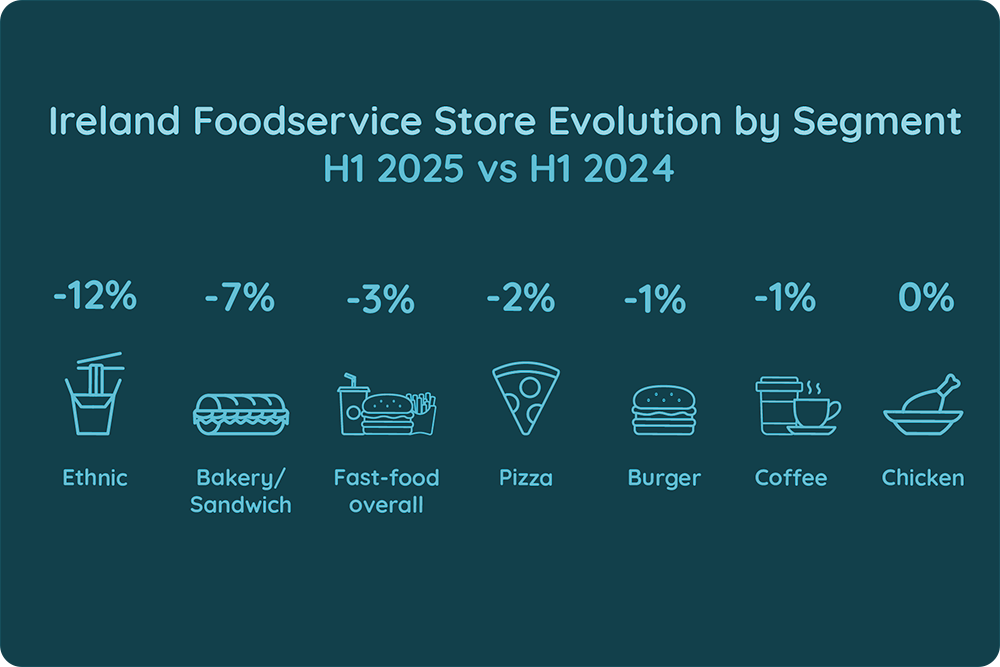

New data shows the total number of fast-food outlets fell 3% year-on-year, while consumer traffic declined 2%. The steepest drop came from quick-service bakeries and sandwich shops, down 7%, following the closure of local names such as Thunders Home Bakery and O’Briens. Ethnic outlets were hit even harder, declining sharply by 12%, signalling how smaller, niche operators are struggling to sustain momentum under cost pressure and changing dining habits.

Yet not everyone is retreating. The burger, chicken, and coffee segments proved far more resilient. Brands like Domino’s, Supermac’s, and Esquires Coffee expanded selectively, using targeted openings to strengthen their presence and capture share from weaker competitors. Even though the overall pizza market softened slightly, Domino’s managed to hold its ground through careful location strategy and delivery growth.

Consumer behaviour helps explain the pattern. As bakeries and sandwich bars contracted, their market share slipped, while categories promising value, familiarity, and convenience, coffee, chicken, and pizza, continued to gain ground. In a cost-sensitive environment, established brands offering consistent quality and reliable pricing remain best placed to weather volatility.

The reshaping of Ireland’s foodservice landscape is far from over. For operators, success will depend less on speed of expansion and more on strategic precision: knowing where demand still grows, when to invest, and how to stand out as consumer expectations evolve.

Maria Vanifatova, CEO of Meaningful Vision, comments: “In uncertain times, growth favours the adaptable. The brands that listen closely to consumers and use insight to refine their strategy will define the next chapter of Ireland’s foodservice story.”