Regional Growth in Ireland Outpaces Dublin, but lags behind Northern Ireland

Our data reveals a changing landscape for chain restaurants in Ireland during the first quarter of 2025.

The number of restaurants in Ireland grew by 1% compared to the same period last year. This expansion was primarily fuelled by strong performances in the fast-food, burger, and coffee shop sectors. Chicken shops were also on the rise. Other fast-food categories saw a slight dip.

Driving the increase in the number of burger restaurants were notable expansions from Burger King, Eddie Rocket’s, and Supermac’s, all of which opened in multiple new locations across Ireland during the past year. Similarly, the coffee shop segment experienced growth thanks to Esquires and Insomnia Coffee adding new stores.

Somewhat surprisingly, Dublin did not share in the growth seen nationwide. The total number of chain restaurants in the capital actually decreased by 2%. By contrast, and in common with a number of other regional areas, Cork saw a healthy 3% increase in chain outlets. This regional growth was particularly strong in the burger and coffee shop segments, which expanded by 8% and 9% respectively outside Dublin.

The coffee shop sector in particular highlights a strategic focus by some of the big chains on opportunities outside of Dublin. Major players like Costa Coffee and Caffè Nero showed no net growth, but whilst seeing fit to wind down a number of locations in the capital, both brands balanced these closures with significant expansion in other regions of Ireland.

Maria Vanifatova, Co-Founder and CEO of Meaningful Vision Ltd, comments, “Our data shows Dublin already has a high concentration of fast-food outlets compared to other major European cities, including London. This indicates the prime areas in Ireland, holding growth potential for both local and international chains, now lie in regional cities. A similar shift was observed in the UK last year, where growth moved from London to regions like the West Midlands and Northern Ireland.”

Consumer Footfall Slows Across Ireland in Early 2025

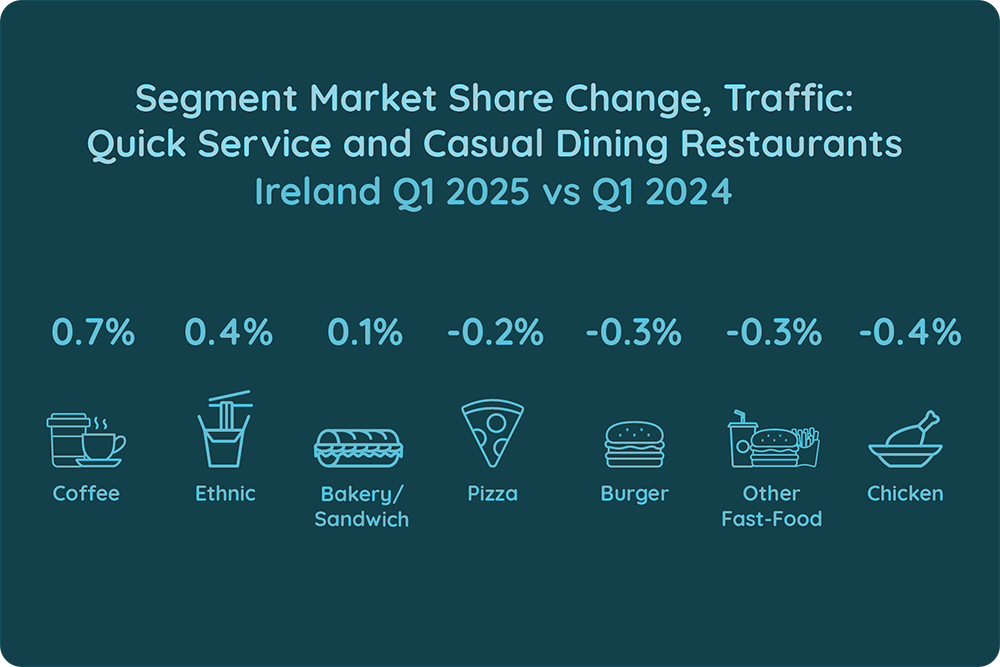

The overall number of foodservice visits in Ireland declined by 4% year-on-year in Q1 2025, reflecting a more cautious attitude to spending on the part of consumers. Burger and chicken outlets experienced the most significant drop in footfall. Interestingly, these segments also recorded the largest increase in the number of stores, suggesting potential over-extension amid slowing demand. Meanwhile, coffee shops and pizza venues proved more resilient, showing the smallest declines in visitor numbers.

Moving beyond nationwide averages, regional data reveals a more complex picture. While Dublin experienced a notable 7% decline in traffic, the rest of the country saw a modest 1% increase. The shift towards decentralisation suggests growing opportunities outside the capital, a trend also mirrored in regional store number evolution. Northern Ireland, in particular, demonstrated healthier traffic trends, with an almost 5% year-on-year increase, closely linked to its growth in outlets.

Seasonal events further influence Ireland’s traffic dynamics. The recent busy Easter period exemplifies how holidays provide an important uplift for hospitality, particularly after Q1 2025’s signs of increasing consumer caution.

According to Meaningful Vision’s data, Ireland experiences a uniquely strong surge in foodservice visits during Easter. Pubs and restaurants saw an average 20% traffic increase, peaking on Good Friday and Saturday with an impressive 36% jump. These days are widely embraced for social gatherings, reflecting the importance of communal dining for many Irish families. While traditional dine-in venues saw the largest gains, fast-food outlets also enjoyed a 17% boost, signalling a strong cultural preference for family-centered socialising during holidays.

In Northern Ireland, this trend is also apparent. Restaurants and pubs outperformed the UK average over Easter, with traffic rising by 19% and 17% respectively. Though fast-food gains were a more modest 3%, the overall picture indicates significantly heightened activity for the hospitality sector, especially on Good Friday and Saturday.

Offsetting the gains seen over the Easter weekend however, morning traffic declined slightly, falling from 19% to 15% of total visits to fast-food restaurants. Both early (6 am – 9 am) and mid-morning (9 am – 12 pm) periods saw reduced footfall. This drop was observed across all major foodservice segments, suggesting fewer consumers are dining out early in the day.

The lunchtime period gained momentum, with its share increasing by 1% in restaurants and almost 2% in fast-food, continuing the trend observed in 2024. Fast-food segments performed particularly well here, posting a 5% year-on-year increase in visits, but burger and chicken chains were the exception, each registering declines.

The afternoon period saw the strongest gain, rising from 29% to 32% in fast-food, and a 4% increase in the number of guests. While burger and chicken segments declined slightly, their losses were less severe compared to the lunchtime dip.

Dinner emerged as the fastest-growing time slot, with a 5% increase in traffic compared to Q1 2024 for fast-food, and an even higher 7% growth for restaurants and pubs. Its market share rose from 14% to 16%, driven primarily by rising visits to burger and pizza restaurants. For restaurants, this daypart brings 25% of overall daily traffic and also grew by 2% in Q1 2025.

By contrast, the late evening period showed a consistent decline in traffic across all segments compared with data from 2024, highlighting a slight shift in consumer behaviour, favouring late-night dining less.

Maria Vanifatova concludes, “Despite an overall drop in visits, the data reveals clear growth opportunities, particularly in afternoon and dinner dayparts, and outside of Dublin. Certain segments, like burgers and chicken, may currently face some challenges to maintain traffic, but the growing number of outlets signals continued brand investment and confidence in the future. Understanding when and where Irish consumers are dining in 2025 will be crucial for foodservice operators looking to succeed in a market undergoing rapid, and often surprising changes”.