At first glance, the UK fast-food sector delivered a solid performance in 2025. Meaningful Vision data shows fast-food footfall increased by 0.9% year on year, in sharp contrast to restaurants and pubs, which together lost almost 7% of visits. However, a closer look reveals that this growth was driven far more by expansion than by rising consumer demand.

Fast-food operators opened close to 1,300 new outlets in 2025, pushing total outlet numbers up by around 2.2%. Once the impact of these new stores is removed, like-for-like visits declined by approximately 1%. In effect, growth came from having more locations, not from consumers visiting more often.

The contrast becomes even clearer when fast food is compared with the wider market. While fast-food outlet numbers expanded by more than 2%, the total number of restaurants and pubs declined by around 2.3%. This relative expansion has allowed fast-food to absorb demand lost elsewhere, creating the appearance of a healthier market.

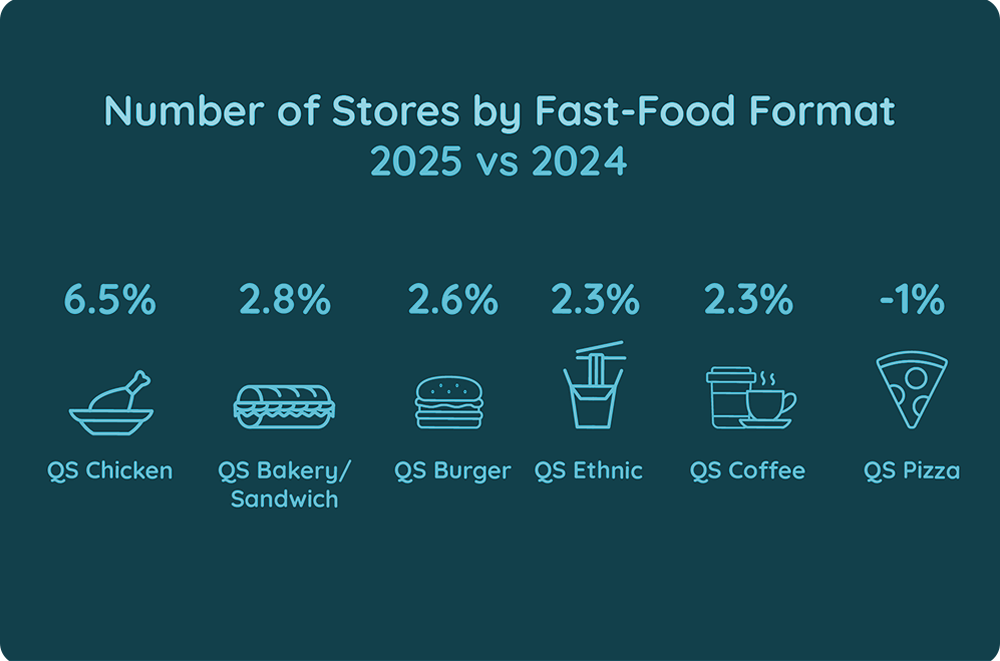

Segment-level data highlights where expansion has been most aggressive. Chicken brands led the way, with store numbers rising by nearly 6.5% year on year, more than three times the average pace of other fast-food segments. Bakery and sandwich formats followed with outlet growth of around 2.8%, while burger chains expanded by roughly 2.6%.

In absolute terms, bakeries accounted for the largest number of new openings, with Greggs remaining the most prolific operator by volume. Within chicken, Popeyes emerged as the fastest-growing brand by percentage, underlining how quickly a new concept can scale in the UK. The segment is set to become even more competitive, with top US brands such as Chick-fil-A and Raising Cane’s entering the market.

Geographically, expansion is no longer led by London. Meaningful Vision data shows Northern Ireland recorded the strongest fast-food outlet growth in 2025, followed by the South of England, reflecting lower saturation levels and more targeted development strategies.

“Fast-food growth in 2025 was almost entirely expansion-led,” said Maria Vanifatova, CEO and Founder of Meaningful Vision. “While outlet numbers grew by more than 2%, like-for-like sales are not increasing. There is still potential to open new stores, and the current economic momentum is relatively strong, but the market is becoming increasingly crowded. With two additional chicken players from the U.S. top three expected to enter the UK, competition in the chicken fast-food segment is likely to intensify sharply. In addition, Meaningful Vision expects further growth from ethnic fast-food concepts.”

“Looking ahead, expansion alone is unlikely to deliver sustainable growth. As more strong players enter the market, average traffic per store is expected to continue to decline. Ongoing outlet openings will intensify competition for demand, increasing the risk of cannibalisation, even for newly launched brands. Expansion-led growth will continue to favour companies with large budgets that can invest in long-term market share growth. For the wider market, this means increased pressure on independent operators and a continued shift towards greater chain dominance.”