2025: A New Wave of Inflation

The UK foodservice sector is bracing itself for a fresh wave of inflationary pressures in 2025 following a period of relative price stability in the preceding year. Data from Meaningful Vision Price Intelligence paints a clear picture: while 2024 saw a levelling off of menu price inflation at 5%, early 2025 saw a significant upturn, driven in no small part by escalating labour costs.

The respite experienced in 2024, where foodservice inflation held steady and retail food and beverage prices even saw a dip to 2%, now appears to have been short-lived. January 2025 figures reveal a concerning trend, with retail prices climbing to 3% and foodservice inflation surging to 6%, the highest point since early 2024. This resurgence is underpinned by a combination of factors, most notably the increasing cost of labour.

National Insurance & Minimum Wage Hikes

The government’s decision to raise Employer National Insurance Contributions (NICs) in April 2025 is a significant factor driving the rise in labour costs and is projected to add a substantial £1 billion to the hospitality sector’s outgoings. This increased financial burden will inevitably force businesses to evaluate their hiring practices and potentially adjust pricing to mitigate the impact.

Adding to this challenge is the substantial 6.7% hike in the national minimum wage, also effective in April 2025. For an industry heavily reliant on a large workforce, this wage increase translates directly into higher operational costs. UK Hospitality estimates that overall labour costs could rise by as much as 10%. While the impact will vary across different segments, with retail, fast food, and casual dining potentially seeing cost increases of 1% to 4%, the foodservice sector, where labour constitutes a larger proportion of overall expenses, will bear the brunt of this surge.

Projected Price Increases: Fast Food & Casual Dining

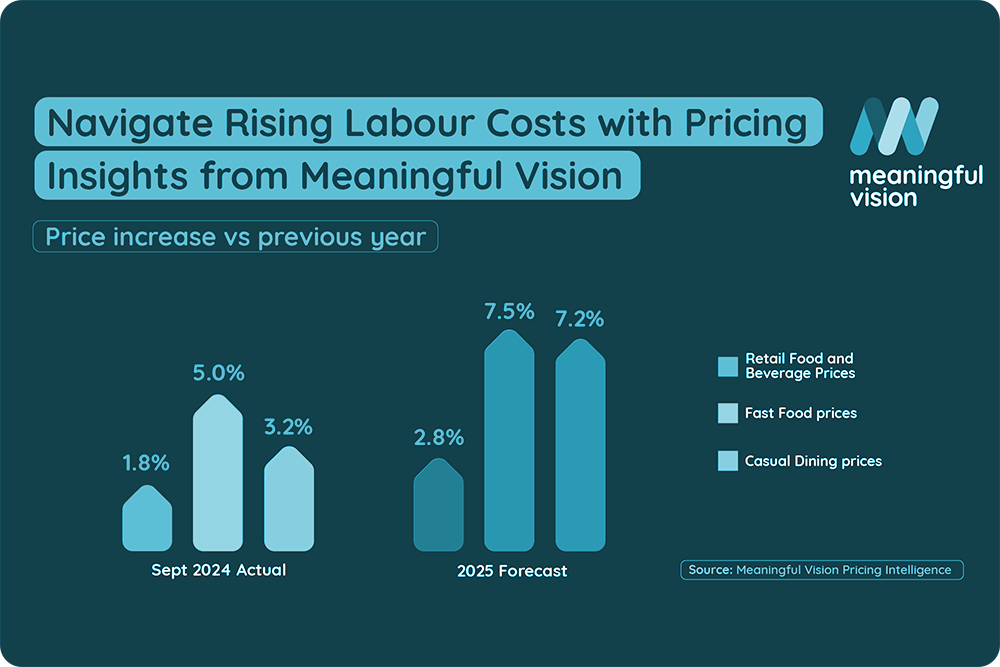

Meaningful Vision forecasts a significant jump in price increases for 2025 compared to the actual data from September 2024. Notably, fast food prices are projected to rise from 5.0% to 7.5%, and casual dining prices from 3.2% to 7.2%. While the graph doesn’t explicitly isolate the impact of labour costs, it strongly suggests that these rising operational expenses, including labour, are a key driver behind the anticipated price hikes.

The critical question facing the industry is the extent to which these increased costs can be passed on to consumers. The current market landscape presents a significant hurdle. Even in the traditionally price-sensitive fast-food sector, traffic has stagnated, indicating a limit to consumers’ willingness to absorb price increases. A further rise in out-of-home dining prices risks making it a less appealing option, potentially leading consumers to opt for more affordable at-home alternatives. Meaningful Vision’s data highlights the delicate balancing act that restaurant and foodservice operators must perform, managing rising costs effectively while remaining mindful of customer affordability in an increasingly price-conscious market. Agility in adapting operational strategies, careful consideration of pricing adjustments, and close monitoring of consumer behaviour will be crucial to successfully navigating a path through the challenging economy in the year ahead.

Read more on the UK pricing surge trends and challenges on our article Foodservice Industry Braces for New Wave of Inflation.