Despite an overall decline in casual dining traffic, our latest data reveals pockets of growth that could significantly impact your strategic planning.

A key performance indicator for restaurants is the rate of Consumer traffic, enlightening the analysis of whether an outlet is losing customers to the competition, or confirming similar trends for the competition; powerful contributors to any business’ strategic plan.

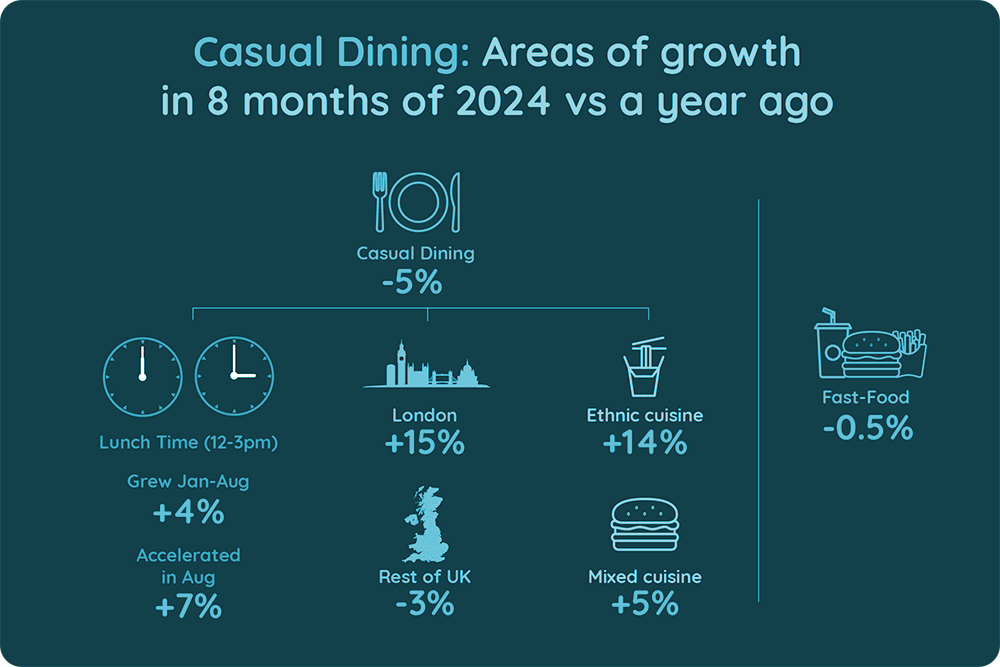

Casual Dining experienced a larger drop in traffic, -5%, compared to their fast food counterparts, -0.5%, Jan-Aug 2024 versus a year ago.

However, this general view hides some significant insights that could easily be neglected, hence potentially steering the strategic plan in the wrong direction.

For example, our regional insights demonstrate that Casual Dining London restaurants are outperforming the rest of the country, with traffic increasing +15%, indicating there is potential to get more bums on seats as consumers wrestle back from the current economic landscape.

Similarly, traffic has increased for certain cuisines with Ethnic up +14% and Mixed +5%, and certain day parts, with lunchtime hours of 12pm-3pm up +4%.

Are you benefiting from these trends? Does this present an opportunity for you? Meaningful Vision can add further light behind these numbers at regional, day, and day part level to help build your strategic plan.

Learn more about our solutions

Meaningful Vision’s platform tracks the performance of the top 100 restaurant chains in the UK on a weekly basis, encompassing various categories such as QSR, Casual Dining, and Coffee Shops. providing detailed and timely insights into all ingredients of marketing mix strategies.

Meaningful Vision’ reports on professional community QSR Media UK .