As the UK foodservice industry navigates through economic fluctuations and evolving consumer behaviours, understanding price trends becomes paramount for businesses to maintain competitiveness and profitability. Recent reports from Meaningful Vision demonstrate the intricacies of price movements within the sector, revealing notable shifts and challenges.

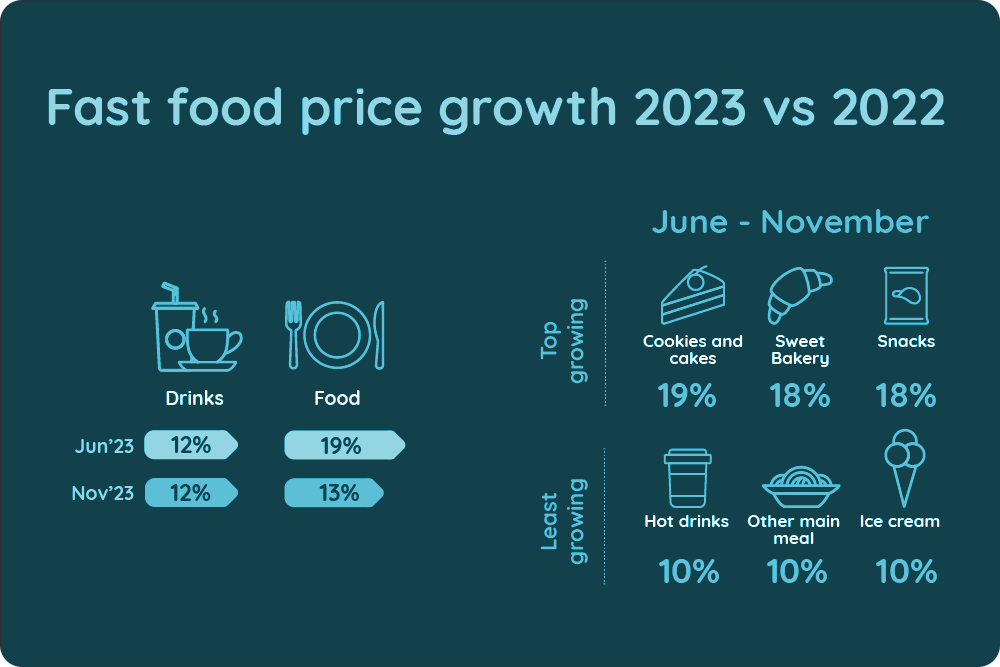

One striking observation from Meaningful Vision’s analysis is the marked discrepancy in price increases across various segments. While there is a discernible slowdown in price growth for food items compared to beverages, the disparity is even more pronounced when considering different price brackets. Higher-priced items experience a more rapid deceleration in price increases compared to their lower-priced counterparts.

Delving deeper into individual menu categories unveils further insights. Main meals, encompassing popular items like burgers, sandwiches, pizza, and meal deals, have seen a notable slowdown in price increases over the past six months. On the contrary, snack categories such as cookies, cakes, snacks, and sweet bakery items continue to witness persistent price hikes, indicating sustained demand for indulgent treats despite economic uncertainties.

Moreover, price variations extend beyond product categories to different regions and cities across the UK. While overall price increases are declining nationwide, regional disparities highlight differences of up to 20-25% between various locations. Cities like Belfast and Manchester exhibit a more rapid decline in price increases compared to others, underscoring the localized nature of pricing dynamics.

However, despite the slowdown in price rises, challenges persist within the industry. Meaningful Vision’s data reveals a 6% decline in the rate of price increases across the sector, coupled with a concerning 3% decrease in overall traffic in the second half of 2023. Even in the budget-friendly fast-food segment, growth stagnates from September onwards, with November witnessing a stark 3% decline in traffic compared to the previous year.

Addressing these challenges requires a multifaceted approach beyond mere price adjustments. Differentiated pricing strategies, meal deals, and promotions emerge as effective instruments to stimulate consumer demand and offset declining foot traffic. Moreover, a weighted pricing policy, informed by comprehensive market insights like those provided by Meaningful Vision, remains essential for businesses to navigate the complexities of the competitive landscape.

While decreasing food price inflation may offer some respite for operators and consumers alike, it’s crucial to acknowledge the broader implications of pricing dynamics within the foodservice industry. Fast-food, coffee shop, and casual dining prices have surged at a greater rate than the general inflation rate for the sector, posing challenges for operators amid declining consumer demand.

In conclusion, staying abreast of food price increases and understanding their implications is imperative for businesses in the UK foodservice industry. By leveraging insights from Meaningful Vision’s comprehensive analysis, operators can devise strategic pricing policies and promotional initiatives to navigate the challenges and seize opportunities for growth in the ever-evolving market landscape.

Download our Infographics to access to the recent data.