Dublin’s fast-food footprint is showing the first real signs of strain. According to Meaningful Vision’s latest data, the capital’s fast-food store count dropped 7% year-on-year, marking its steepest contraction in three years. With 40 fast -food outlets per 100,000 residents, a density higher than London’s 34, Dublin now represents a saturated market where competition for footfall is intense and expansion potential limited.

In contrast, regional Ireland is picking up pace. The Northern and Western regions posted +3% outlet growth in H1 2025, driven by active development in burger, coffee, and chicken chains. Northern Ireland stands out as the top performer, recording an impressive +18% growth in store count supported by new market entrants.

Across the Republic, counties like Cork, Galway, and Louth are driving momentum. Cork’s outlet count grew +1%, fuelled by coffee and burger formats expanding into suburban locations. Galway is following a similar trajectory, with café formats benefitting from hybrid-working populations and steady daytime trade.

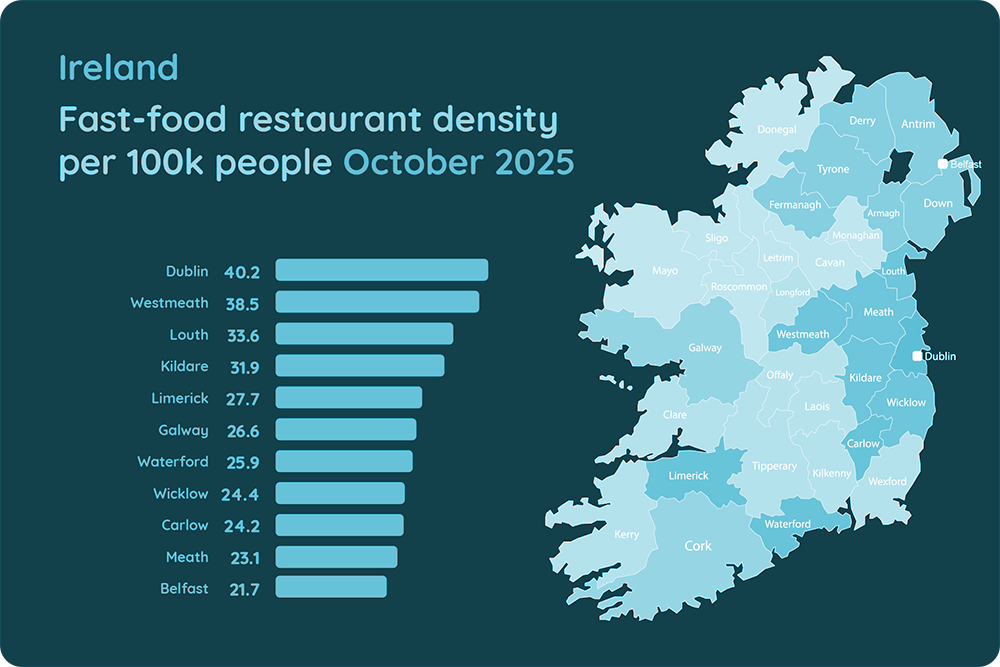

Ireland’s national average stands at 28 fast-food outlets per 100,000 people, but density varies sharply. Dublin, Westmeath, Louth, and Kildare sit well above this benchmark, reflecting the growing pull of commuter belts outside the capital. In contrast, Wexford, Clare, Cavan, and Roscommon remain far below the national average, highlighting under-served regions with substantial headroom for growth.

Segment performance also shows widening gaps. The steepest drop came from quick-service bakeries and sandwich shops, down 7%, following the closure of local names such as Thunders Home Bakery and O’Briens. Ethnic outlets were hit even harder, declining sharply by 12%, signalling how smaller, niche operators are struggling to sustain momentum under cost pressure and changing dining habits.

Maria Vanifatova, CEO of Meaningful Vision, notes: “While total chained fast-food outlets in Ireland declined 3% in H1 2025, this national figure masks an important divide: contraction in Dublin versus measured growth across regional markets. Increasingly, more openings are occurring outside the capital, where density is lower. Recent openings, such as Taco Bell in Meath in September 2025 and Wendy’s in Cork in October 2025, reinforce this trend and validate the strong growth potential in the counties.”

Competition is intensifying as new international brands enter Ireland, raising the stakes for mature operators. Dublin is no longer the centre of gravity. Regional markets, from Cork to Northern Ireland, are now the real opportunity zones. Success will belong to brands that combine insight-led location strategy with agile, data-driven expansion.”

Watch the Meaningful Vision webinar focusing on Irish Foodservice industry trends: The State of Irish Foodservice.