Our solutions

We provide a 360º view of the competition in the Foodservice industry, including:

- Consumer traffic and footfall data analysis

- Menu composition

- Price and Promo intelligence

- Stores openings

- Closures and location analysis

- Advisory services

Customer traffic

intelligence

Price intelligence

Promo intelligence

Advisoryservices

Menu intelligence

Locationintelligence

Our Countries

We began collecting data in the UK in 2021

Market Coverage

Top 100 chains including Fast food outlets, Coffee shops, Pubs and Casual Dining Restaurants

Channel Coverage

In store, Takeaway, Delivery (Deliveroo, JustEat, UberEats)

Granular Data

We offer the most precise and up-to-date information on regional level – from customised regions, and franchisee territories, to cities and city areas

Begin your Journey Today

Define your competitors, and experience our competition scanner.

Track your competition

Monitor your competitors with our comprehensive solutions. From answering your inquiries about market participants, to providing real-time insights into the day-to-day activities of key players in the industry, we equip you with the tools to stay informed and competitive. Whether you’re a chain or a supplier, our up-to-date information keeps you one step ahead in the market.

- For restaurant

- Who is growing faster compared with my business?

- Is the growth like for like, or driven by new openings?

- What are the key growth opportunities for my business?

- How does the performance of my franchisees compare to my competitors?

- For supplier

- Which existing chains could supply my products?

- Which emerging chains should I partner with?

- Which products are most effective in fulfilling the growth ambitions of these chains?

- What are the main opportunities for my products?

- For restaurant

- How can I determine the optimal pricing for my new product?

- What's the best approach to handle a price increase effectively?

- How do my prices compare with competitors?

- Should I vary prices for in-store vs delivery, and takeaway?

- For supplier

- How do my price benchmarks compare to the competition?

- What price increases should I be considering?

- What is the optimal pricing for a new product?

- How should I set prices for different channels?

- For restaurant

- What promo techniques are my competitors using?

- What special offers are available for delivery?

- How many meal deals do my competitors offer, and at what price?

- What products do they promote the most?

- For supplier

- What are the most popular techniques for promoting my products?

- How many meal deals contain my product?

- What promos are used in-store and for delivery?

- How deep are the price discounts for my product?

- For restaurant

- Which products are suitable for exclusives for dine in or app users?

- How can I set my pricing for different channels?

- What promos do my competitors use in apps and delivery aggregators?

- For supplier

- Do I need to offer different products/packaging for dine in, takeaway and delivery?

- How should I set prices for different channels?

- What are the most popular techniques for promoting specific product categories, in each channel?

- For restaurant

- Which product categories in my menu have the highest growth potential?

- What plant-based products have my competitors introduced to the market?

- What are competitors' seasonal and limited offers?

- What is my competitors' menu structure?

- For supplier

- Which stores have a gap in my product category?

- What competing products have launched recently?

- How many meal deals contain my product?

- How big are seasonal offers and LTO’s for my key accounts?

- For restaurant

- How many competitor stores operate in this area compared with my business?

- What is their average traffic per store?

- Which of my competitors recently opened new restaurants, and where are they located?

- Where should I open my next store?

- For supplier

- How many restaurants in the area could sell my products?

- Which emerging chains are potential customers for supplying my products in the area?

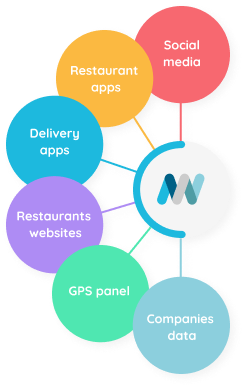

Our methodology

We collect data from restaurant applications, websites, social media platforms, and delivery aggregators across geographical locations. This comprehensive approach ensures valuable insights derived from diverse sources.

Our footfall traffic data is generated by 6M mobile phone users and linked to more than 25k locations.

Utilising intensive multi-stage checking and cleaning processes we ensure our data is the most accurate in the industry.

Access the latest Foodservice market insights by signing up below

How can we help your business grow?

Get in touch with our experts today and find the best solutions for your organisation