While consumer demand for affordable treats remains solid, pricing pressures continue to mount.

The average price of hot drinks increased by nearly 9% year-on-year in September, surpassing the overall fast-food average increase of 7%. Core items such as cappuccino and latte prices rose by about 9%, while specialty drinks have surged even more sharply. Seasonal drinks, such as pumpkin spice or gingerbread lattes, cost on average 22–25% more than standard offerings, representing an 11% increase compared to a year ago.

The price gap between fast-food outlets and coffee specialists remains wide with significant variation. The spread between fast-food players such as McDonald’s and Popeyes (£1.99) and leading coffee chains such as Costa Coffee, Starbucks (£4), or even premium outlets such as Joe & The Juice, Watchhouse and Gails (£4.30) is more than 100%.

But these days coffee is not only consumed in cafes, or even collected from one in person. Delivery is adding another layer to the price equation and makes coffee even more expensive. The average markup for drinks ordered through apps is 15%, meaning an in-store coffee priced at £3.80 can easily reach £4.35 or more when delivered.

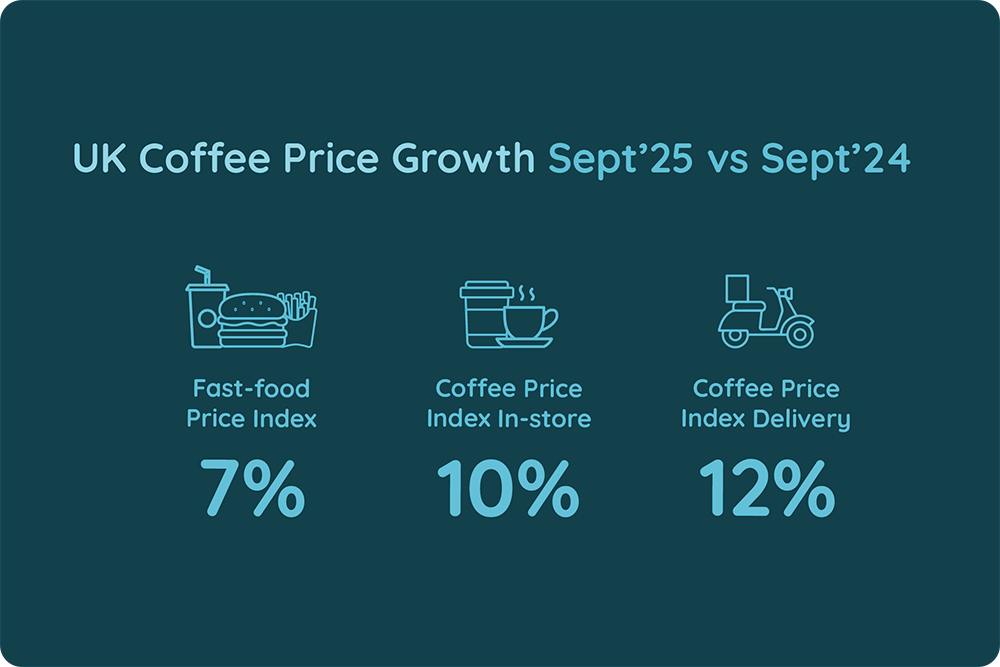

It’s also worth noting that delivery prices are growing faster than in-store prices for all products, including coffee. Importantly, delivery prices are rising faster than in-store: if coffee prices in coffee shops increased 10%, delivery equivalents rose 12%. Thus, for top coffee items, the difference in price growth is about two percentage points.

“Coffee is among the categories we predict will see significant price growth this year” states Maria Vanifatova, CEO of Meaningful Vision. Higher prices for delivery and faster price growth in this channel may impact sales, especially with products like hot coffee which consumers require delivered at a temperature matching their expectations, but which often arrives luke-warm or cold, or having been spilled in transit. This explains why the menu assortment on offer may be limited and why consumers routinely report the delivery option less favourably than the in-store experience. As competition intensifies and consumers become more selective about when and where they spend, coffee brands may benefit from rethinking their value proposition and how it aligns with their competitors.”