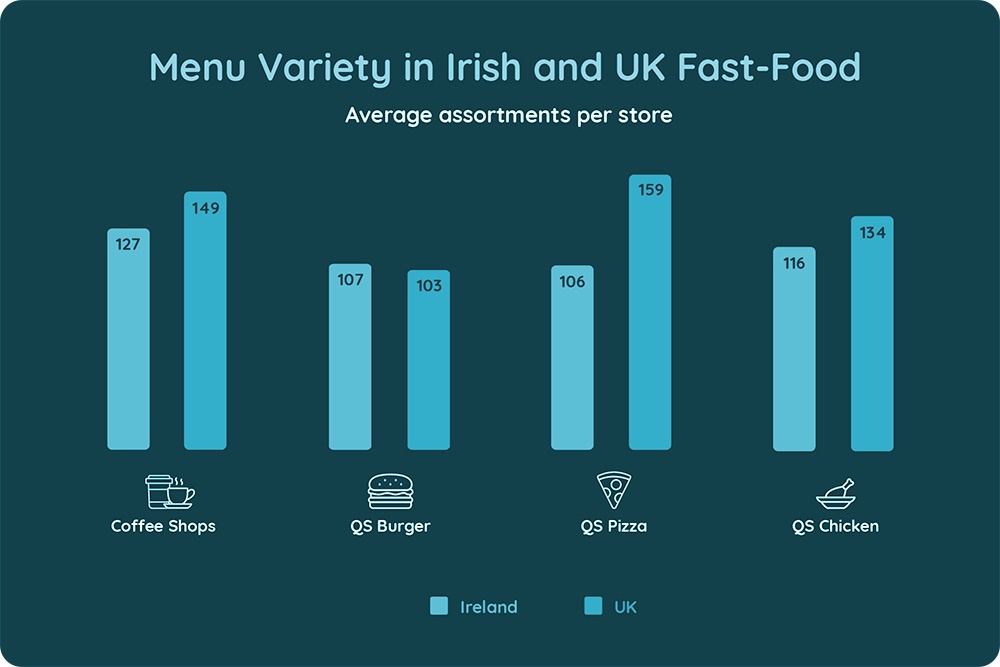

The Irish fast-food market continues to evolve, not only in outlet growth, but also in the breadth and depth of menu assortments across key segments. As of Q1 2025, coffee shops boast the largest variety of products, averaging 127 menu items per store, compared to just over 100 at burger and pizza outlets. This statistic reveals the strategic focus placed by coffee shops on beverages, breakfast, and snacks, in an effort to meet growing consumer demand. By comparison, UK outlets generally offer around 10% more items, driven by a wider range of pizza and chicken options, along with more meal deals and an expanded selection of breakfast and snack items.

Examining menu structures offers insight into how different segments aim to capture consumer occasions. Coffee shops enjoy the highest traffic of any segment during the morning and afternoon periods, where drinks make up 52% of offerings (34% cold and 18% hot) while bakery items comprise 21%.

In burger outlets, meal deals top the chart with 26% of menus, followed by burgers, sandwiches, and wraps at 17%. Sides and desserts remain present but secondary, with sides at 10% and cookies, cakes, and bakery at 9%. This structure shows how burger chains balance value bundles with indulgence-led add-ons to capture incremental spend.

Chicken outlets offer an even greater number of meal deals, accounting for 31% of their menus – the highest share of any segment. Burgers, sandwiches and wraps (14%) and other main meals (12%) provide further variety, but the focus is clear: bundles that offer both value and convenience.

Pizza chains offer a highly focused menu, with pizzas dominating 36% of their assortment, complimented by meal deals (19%) and sides (10%). Although they offer less variety than other segments, pizza chains remain highly competitive in the delivery space, bolstered by strong local players like Apache Pizza and Four Star Pizza.

Segment underrepresentation is also striking. Ireland trails the UK in chicken and bakery/sandwich penetration, suggesting headroom for international entrants like Popeyes and Wingstop, both expected to expand locally. At the same time, pizza’s relative overperformance highlights both consumer affinity and the strength of established domestic operators.

Looking ahead, assortment strategies will remain central to competitive positioning. Coffee shops leverage variety and all-day appeal, pizzas consolidate delivery dominance, and chicken builds momentum by leaning on value-led meal deals.

Maria Vanifatova, CEO of Meaningful Vision, notes: “What we see today are not only broader menus, but smarter ones. Coffee shops already lead in variety, pizzas dominate delivery, and chicken is emerging as the growth engine with 31% of menus built around meal deals. These shifts underline, consumers are seeking value – and where brands must compete.”

The Irish fast-food market is a story of balance, between local and global, between variety and focus. Coffee shops are shaping daily routines, pizza chains are defending home turf through delivery, and chicken brands are redefining value with bundle-driven menus. The future will belong to operators who move beyond discounting and build relevance through tailored, occasion-driven experiences.

Read more on the Irish Foodservice Industry trends in our blog and download our latest infographics for more insights.