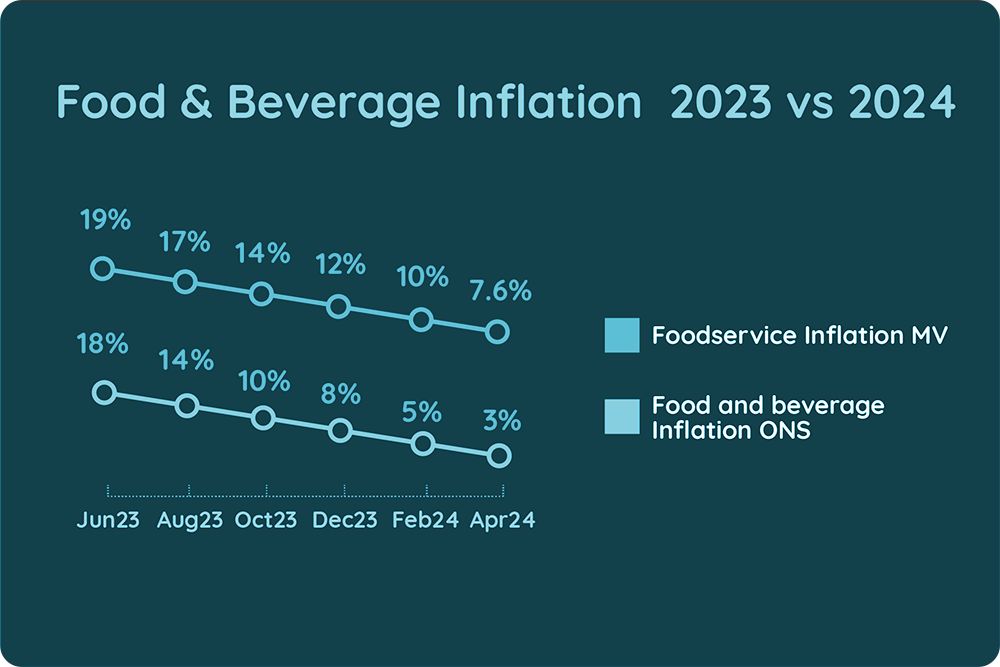

While overall inflation shows signs of easing, the UK’s foodservice industry, including fast-food outlets, coffee shops, and casual dining, faces a major challenge. Although menu price inflation in restaurants slowed to 7.6% in April 2024, a significant gap of around 5% remains compared to food and beverage prices in retail outlets. Despite this slowdown, foodservice inflation still significantly outpaces retail inflation, leaving operators in a difficult situation.

The Office for National Statistics (ONS) reports that food and non-alcoholic beverage inflation dropped significantly to 2.9% in April 2024, down from 18% in June 2023 and 8% in December 2023. Research by Meaningful Vision reveals a comparable trend in foodservice menu price inflation. In June 2023, the foodservice inflation rate was 19%, nearly matching retail prices. By December 2023, it had decreased to 12%, although at a slower pace than the retail decline. Menu price growth in foodservice has continued to decline steadily since then, reaching 7.6% in April 2024.

However, a significant gap remains. The ONS reports food and beverage inflation at a much lower 2.9% for April, translating to a persistent 5% price difference between grocery and foodservice.

Meaningful Vision CEO, Maria Vanifatova, emphasises a crucial point: ‘While the slow down in food price inflation comes as welcome news, the faster pace of price hikes within the hospitality sector when compared to retail food and beverage prices is concerning. Relatively speaking, restaurant prices today are higher than in the recent past, which could limit further increases in consumer demand.’

Read more on pricing strategies here.