The UK pizza delivery market is in a league of its own when it comes to competition. Unlike other fast-food segments, pizza brands face an exceptionally fierce battle for customer loyalty, driven by structural factors that amplify price sensitivity and discount reliance.

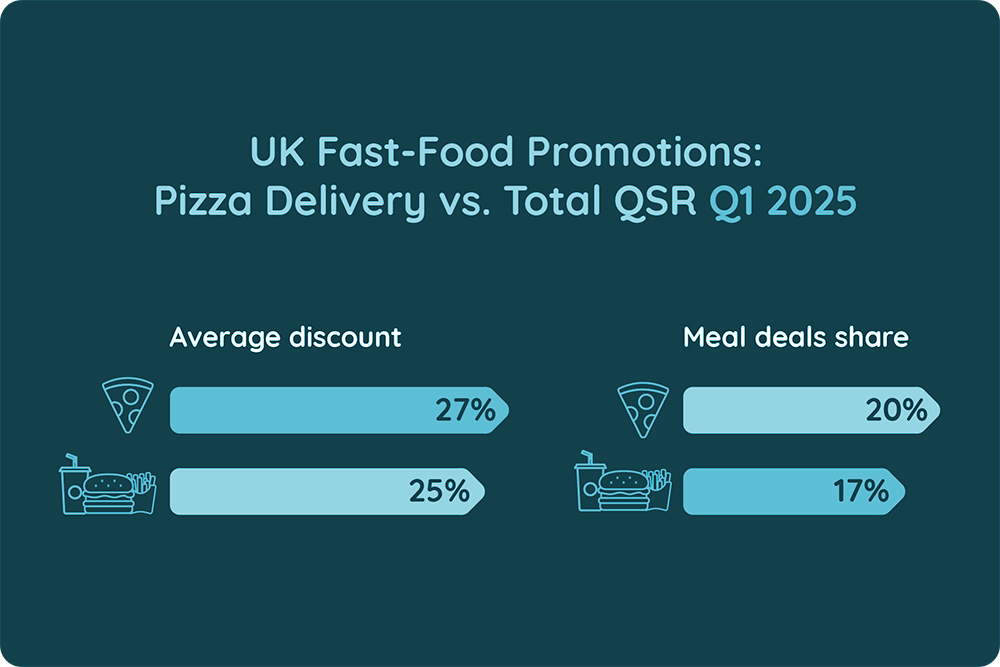

Consumers rarely pay full price for pizza, as the segment thrives on a relentless cycle of meal deals and discounts. While a medium pizza from major delivery brands costs nearly 40% less than at casual dining chains, the real story lies in promotions. In Q1 2025, the share of meal deals in pizza delivery menus surged to 20%, notably higher than the 17% average for other fast-food segments. Remarkably, despite inflationary pressures, the average price of pizza meal deals has actually declined by 2%.

Adding to this complexity is the “Delivery Dilemma.” Pizza chains primarily rely on delivery, partnering with platforms like Uber Eats and Just Eat, yet simultaneously competing with them. Unlike other fast-food categories where delivery prices are often 20% higher than in-store, pizza’s price gap is minimal, with own-brand delivery sometimes even being cheaper than aggregators. While platform delivery fees remain higher, the sheer volume of promotions pushes the competitive envelope.

Meaningful Vision’s latest data underscores this promotional intensity. In Q1 2025, the average discount offered for pizza delivery stood at 27%, exceeding the 25% average across the total fast-food market. This greater discounting in pizza reflects a reluctance to raise base prices, as QSR pizza prices rose just 2% in Q1 2025, compared to a 5% increase across the broader QSR category. This preference for promotions over overt price hikes is a direct response to consumer price sensitivity.

As Meaningful Vision CEO Maria Vanifatova notes, “Despite fierce competition and low brand loyalty, pizza loyalty programs are surprisingly underdeveloped.” This leaves pizza chains vulnerable, facing intense price and delivery pressure while underperforming in customer retention. To thrive, brands need a strategic, data-driven approach, actively monitoring rivals and optimising their omni-channel strategies to win share and loyalty in this high-stakes market.

Read more on the Pizza Promotions tactics in our article Why Pizza Chains Face the Toughest Competition in Fast-Food.